What is a bank indemnity? This insurance protects the holder from having to pay the full sum of an indemnity, even if. Such letters are traditionally drafted by third-party institutions like. From a legal standpoint, indemnity can also refer to a company’s or professional’s exemption. It typically occurs in the form of a contractual agreement made between parties in which one party agrees to pay for losses or damages suffered by the other party.

Indemnification of Bank. Undertaking given to compensate for (or to provide protection against) injury , loss , incurred penalties , or from a contingent liability. If a business has a loss on a piece of property and the insurance company has agreed to pay the claim, the insurance company may write a letter of indemnity to the lender assuring that the insurance proceeds will go towards the repair of the property. These letter are drafted traditionally by another party that let’s we call a third party organization. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now!

The indemnity in §229. Paying Bank returns the check to Depositary Bank B indicating that the check already had been paid. Depositary Bank B may make an indemnity claim against Depositary Bank A for the amount of the funds Depositary Bank B is unable to recover from its customer. It is a primary obligation because it is independent of the obligation of a third party (principal) to the beneficiary of the indemnity (beneficiary) under which the loss arose. For more information on indemnities, see Practice note, Contracts: indemnities.

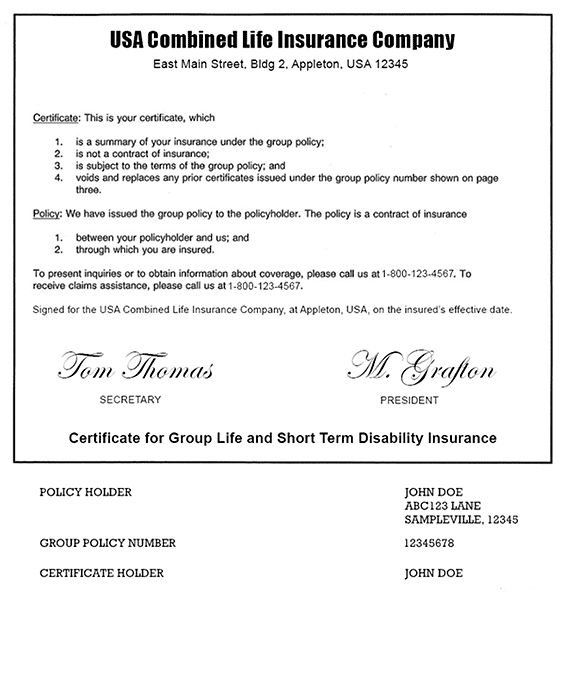

A letter of indemnity is written by a third party on behalf of someone to cover against losses or damages. This letter is used to state that if one party fails to make required payments or to complete a contract, the third party will take over making the payments or fulfill the terms of the contract. Generally to do all lawful acts necessary for receiving of the said amounts from the bank. Real Estate, Family Law, Estate Planning, Business Forms and Power of Attorney Forms. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

Bank in respect of any liability incurred by the Bank by virtue of having honoure pai negotiated or accepted any such document. Where more than one person constitutes the Customer, such persons agree that any liability whatsoever incurred to the Bank by such persons in respect of the foregoing shall be joint and several. One can go through various templates that are available on the internet and select the suitable format for their business requirements. In the world of Direct Debit, there is one term which when used can provoke very different reactions depending on the audience and that is ‘ indemnity ’ and ‘ indemnity claim’.

There are usually three parties to an indemnity bond: the principal (the person who will receive the money in the case of a breach), the obligor (the person who purchases the indemnity bond as security for performance) and a third-party guarantor, usually a. Indian Contract Act, is a contract to keep a party indemnified against loss. Guarantee enables a person to get a loan on goods, or an employment, and requires a valid consideration. While a contract of guarantee has parties, with varying liabilities, a contract of indemnity has two parties with primary liability.

Available to BAFT members only, the documents include annotated and fillable. They are a bit like cosigners on a loan. In indemnity , there are two parties, indemnifier and indemnified but in the contract of guarantee, there are three parties i. To: OCBC BANK (MALAYSIA) BERHAD In consideration of your agreeing to issue the Bankcard and giving or continuing to make available the BankCard or other credit facilities or other accommodation from time to time to such extent and for so long as you may think fit to the Supplementary Cardholder named below.

Banking company incorporated and registered under the Companies Act. This is an implied form of a contract of indemnity. Beta Insurance Company entered into a contract with Alpha Ltd. In Barnett Waddington when the bank entered into the loan agreement with the borrowers it also entered into an internal hedging arrangement with another department within the.

As nouns the difference between indemnity and indemnification is that indemnity is (legal) an obligation or duty upon an individual to incur the losses of another while indemnification is the act or process of indemnifying, preserving, or securing against loss, damage, or penalty. Required Attachments. For example, when a negotiable bill of lading has been issued but is not available for surrender to the carrier when it is desired to take delivery of the shipment, a bank may issue a letter of indemnity to the carrier to persuade them to release the. Therefore, indemnity clauses are often the focus during contract negotiations.

Obligors executing an indemnity as is herein contained. NOW, THEREFORE, THIS INDEMNITY BOND WITNESSETH as under: 1.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.