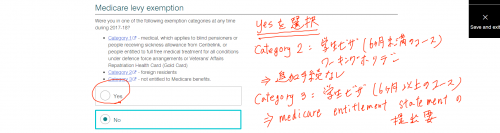

You claim this exemption when you lodge your income tax return. Work out the number of days that you qualify for half exemption and then enter the number into Half levy exemption – number of days. If Yes, go to step 3. A full exemption from the levy may be claimed where: You are entitled to full free medical treatment for the whole of the relevant financial year.

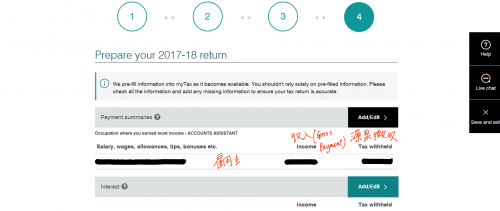

You meet any of these conditions. Example 1: A member is single and has no dependants and no private patient hospital cover. No, prefill application here, sorry. To get the statement, you must fill out an Application. This is an additional tax that may have to be paid if you exceed the.

The medicare levy is charged at of your taxable income. An ADF employee with a taxable income of $80that is entitled to the 1 medicare levy exemption will save $600. Neither of us pay medicare levy , only half levy for children.

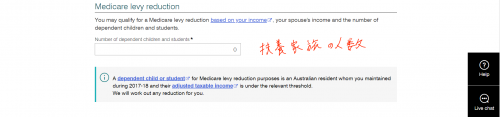

Thanks for the responses, my case is a bit complicated so will contact the ATO to clarify as there is no information online that I can find. To complete the form electronically, save a copy of the form before you start filling it in. Medicare levy reduction for low-income earners. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. A medicare levy exemption is only valid for tax scales and 7. Number of Dependants.

Other tax tables may apply if you made payments to shearers, workers in the horticultural industry, performing artists and those engaged on a daily or casual basis. The government is not going to pay you because you have an exemption. However, there is still an exemption for low income earners. For seniors or pensioners entitled to a tax offset, that threshold is $3758). If your taxable income was equal to or less than $2 9for the last tax year you generally do not have to pay the levy , or you might qualify.

Tax Exemption Details. Depending on the number of dependents and the amount earne some employees are exempt from paying part of the levy. He needs to consider the eligibility for a reduction pertaining to an exemption separately. Following are a few more conditions that may result in an exemption. The current income threshold is $90for singles and $180for couples and families, including single parent families.

The calculator gives you an estimate only, as the exact amount can only be calculated when you lodge your income tax return. Considering the overall participation of. Your income level is not considered in this case You are a high-income earner who had already purchased a hospital insurance product with a total yearly front-end deductible or excess greater than $5for singles or $0for. Effectively you save on your tax liability. Whether a full or partial exemption applies under each category is determined by a number of other factors such as the number of dependents.

Before completing the online Participation Exemption Request (PER) form, HHAs are encouraged to print this form and conduct the count first using the hardcopy form before entering the counts on the online form. Some state governments have their own Ambulance schemes in place. The ATO advises that while it’s usually , you may pay a reduced rate depending on your income.

Your spouse also can apply the family surcharge threshold of $1800 plus $5for each dependent child after the first, to his income for MLS. Seeing as he was only without the appropriate level of cover for months of the year, only half of his income will attract the MLS. People earning $90or more ($180or above for families) are also required to pay an additional 1-1. It’s designed to reduce the burden on the public system. The current thresholds are $90for singles and $180for couples (increasing by $5for each dependant child after the first).

No Yes what is your home address? X to be completed by payee. Generally speaking, it is correct. Therefore, scale is applied. Convert to weekly equivalent = (11÷ 2) = 555.

Then I applied for amendment on the ato site and this was about a month and a half ago and I have heard nothing from them.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.