What is a beneficiary bank? Many banks offer payable-on-death (POD) accounts as part of their standard offerings. A POD account instructs the bank to pass on a client’s assets to the beneficiary, which means money in a POD account is.

Beneficiaries are either named specifically in. A beneficiary designation, however, is different. In some cases, an account holder designates a primary bank account beneficiary and a secondary beneficiary. After your death, the account beneficiary can immediately claim ownership of the account. Before you set up your account, let’s examine the bank account beneficiary rules more closely.

Why are the beneficiary bank name and address. As the associate, you are the beneficiary of any dependent life or dependent ADD insurance you may have elected. The POD is also known as a transfer-on-death, or TO account, also called a Totten trust. Your bank or credit union will add the beneficiary to your account free of charge.

If you have established a trust, the beneficiary you name receives the assets of the trust. You can change the beneficiary as often as you like. Insurance policies and retirement plans have designated beneficiaries and the proceeds go directly to these individuals without the necessity of probate when you die. The same holds true for bank accounts in some states. Naming a beneficiary turns it into a payable-on-death account that can pass directly to a beneficiary with minimum fuss.

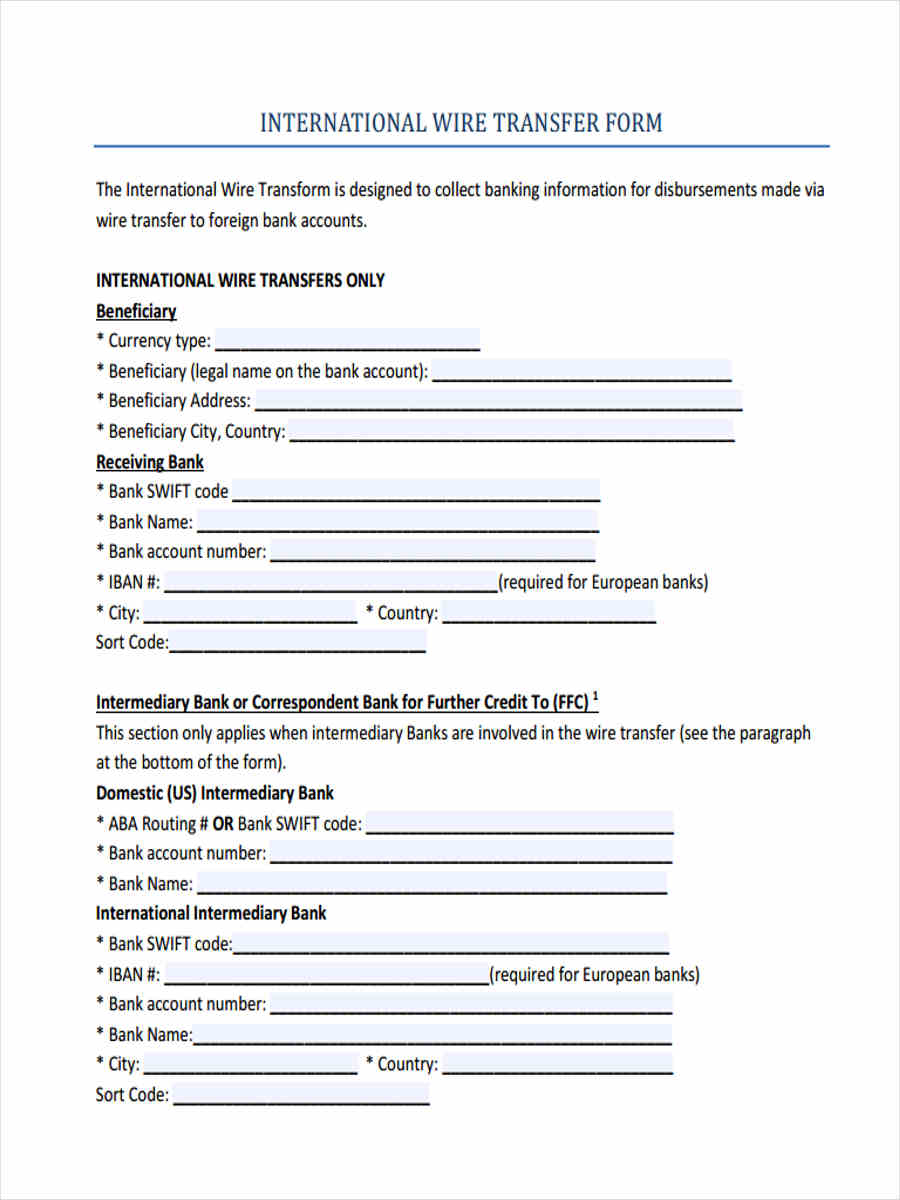

Enter account details of the beneficiary the details which you need to enter are mentioned below. A POD (Payable on Death) beneficiary is someone that you name as a recipient of the funds within your account upon death. As the account owner, you control the money, and you can ad modify, or remove beneficiaries at your discretion.

The beneficiaries of the estate are the people entitled to receive those assets. The executor is often, but not always, also a beneficiary. Learn more about how to choose a beneficiary and why it is important to select someone yourself.

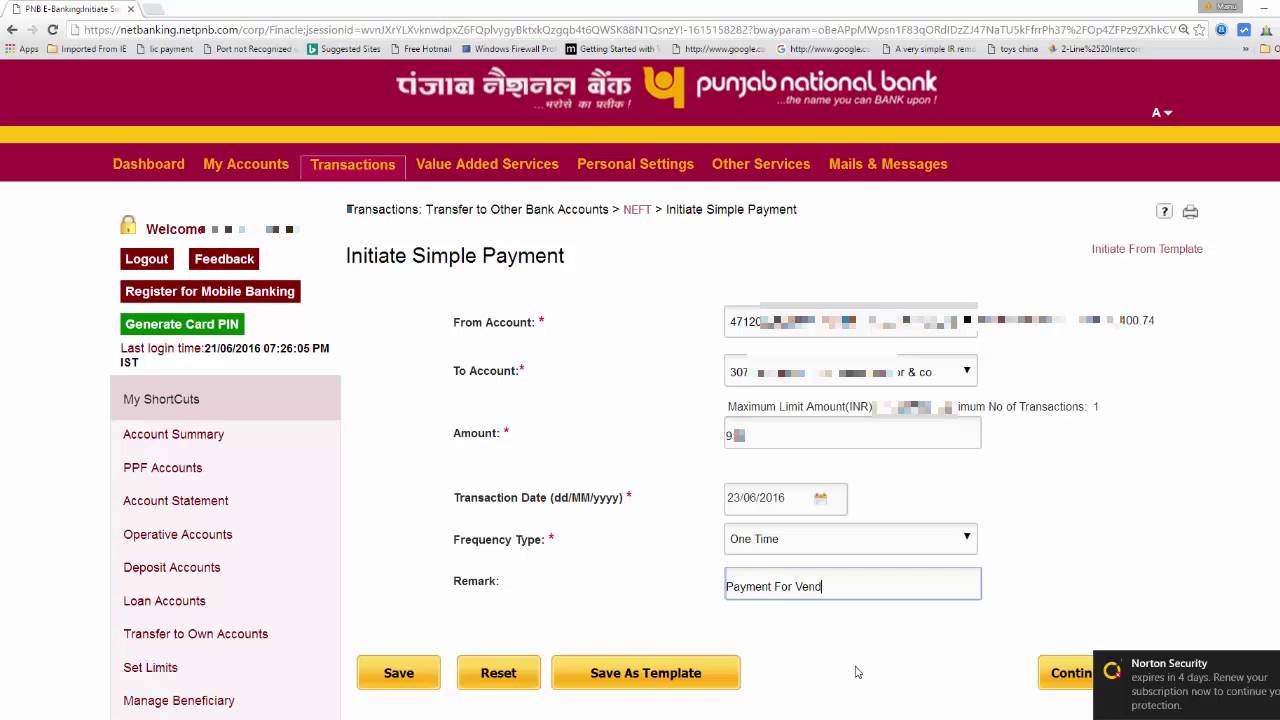

A bank account with designated POD beneficiaries is an arrangement between a bank and an account owner (s) that allows beneficiaries to receive the funds in the account (s) when all owners pass away. So, enter nick name, beneficiary account number, IFSC, MPIN and click on Submit. So, follow below steps: First of all open the app. Finally your beneficiary will be added.

Through Mobile Banking. Open the of Central Bank of India. to your account by entering your User ID and Passwor for enhanced protection you can use the virtual keyboard. Once you successfully to your account you will see many options on your screen. From those options select “Add.

Select the “Transaction Type” from Funds Transfer section in NetBanking and click on the “GO” icon. Federal banking regulations allow a bank account holder to designate another person to receive the balance of the account in the event of his death. The person designated to receive the funds after the account holder’s death is called a beneficiary.

As you may already know, you can designate POD (payable-on-death) beneficiaries for bank accounts (the bank will provide the paperwork) and TOD (transfer-on-death) beneficiaries for your stocks (ask your broker or the company for forms). Immediate Access —With adequate. For many people the beneficiary is a spouse, child or another family member. When an account owner dies, the beneficiary collects the money.

There’s no probate process or lengthy waiting period. The problem is this: the beneficiary designation is a legally binding document and it supersedes your will. That means regardless of your current relationship status, and regardless of what your current will says, the asset will go to the person you named in the beneficiary designation whenever you last updated it.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.