A managing agent acts on behalf of the property owner. Married couples must receive separate CRPs showing they each paid an equal portion of rent. The property is tax-exempt, but you made payments in lieu of property taxes. This form must be filed by January 31. Why is this form used in Minnesota?

Just as you can get some deductions as a landlor tenants in Minnesota can get some deductions, too! You can print other Minnesota tax forms here. CRP Gen by Smartrak Group, Inc. Wisconsin Department of Revenue. Property owners and managing agents who are registered in e-Services as a business now have the option to bulk upload renter information and submit CRPs to Revenue electronically.

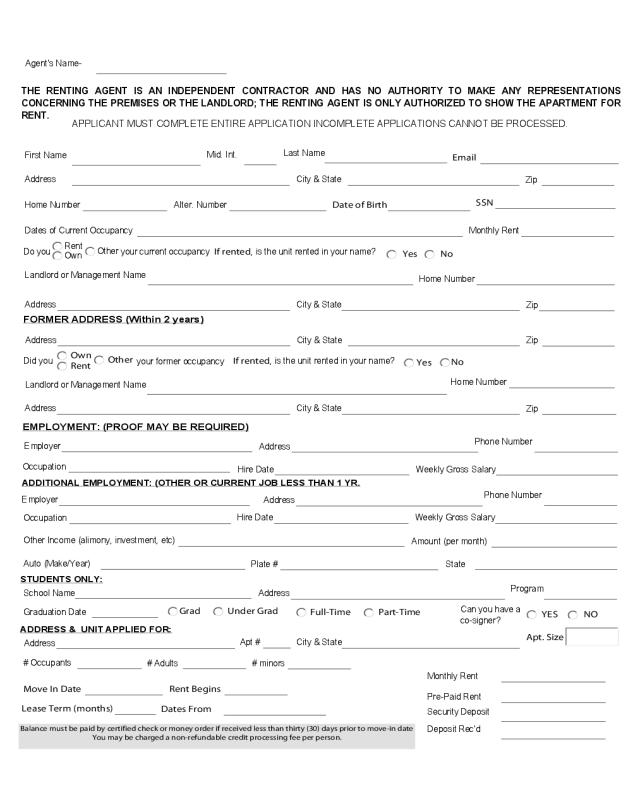

Currently, this is only available for registered e-Services users. It does not go on your Federal return. If filing as a renter, you must provide proof of the rent you paid. PA RENT CERTIFICATE Your landlord must provide all the information on Lines through 8. Attach rent receipt (s) for each rent payment for the entire year, a signed statement from your landlor or copies of canceled checks (front and back).

New Jersey – The New Jersey benefit is interesting because it gives renters a choice as to whether they would prefer a deduction of percent of rent paid or a credit of $on their tax return. Multiply Line by. Certification of Rent Paid Form MO-CRP 1. Incomplete claims will delay processing. You may be contacted for additional information.

The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money!

You paid rent in a building which was taxed OR you own your home. How do I get my refund? Deducting rent on taxes is not permitted by the IRS.

However, if you use the property for your trade or business, you may be able to deduct a portion of the rent from your taxes. The amount you can deduct is based the how many square feet of the property is used for your business. If you own, use your Property Tax Statement. Look for a page titled Other Forms You May Need. Check the first box, Property Tax Refund (Form M1PR).

There are several screens related to the CRP, so it is important that you continue through the screens and answer all of the questions. Verification of Rent Paid. Landlord Information.

Each place you resided in that financial year, you have to show the certificate that you have paid the rent. OWNER OR MANAGING AGENT TO FURNISH RENT CERTIFICATE. The owner or managing agent of any property for which rent is paid for occupancy as a homestead must furnish a certificate of rent paid to a person who is a renter on December 3 in the form prescribed by the commissioner. You owned and occupied your home and paid property taxes and paid rent for the land upon which disability, or Black Lung disability, provide a copy.

You must have your CRP to determine your property tax refund and you will include it when filing your property tax return. Are you in Minnesota? Complete this form if you lived in more than one location. Use as many sheets as necessary. Submit a copy along with your Iowa Rent Reimbursement claim.

Your last name, first name: Your Social Security Number: Rental Address. The location where you lived must be subject to property tax. TDS certificate received form your employer.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.