I am not sure where everyone gets their info around here. In America right of survivorship means that when one dies the other owner retains all rights to the account. This type of account is not subject to the will or the probate court. Even people who answer your question are answering it with misinformation. How would I know says criminals will be rewarded.

These were children who were brought in illegaly by their parents. They are not responsible for that. I had my permanent GC in the mail not even weeks later. Your lawyer sounds useless.

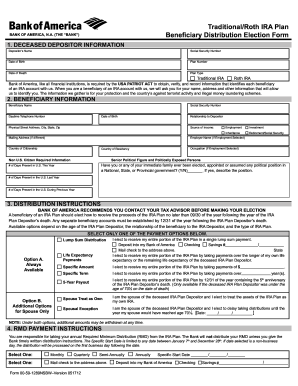

Pay-on-Death Accounts. When you name a POD beneficiary , you do not give up control or ownership of your bank account. The POD beneficiary cannot. For an individual or joint account, you may choose to make your account payable on your death to one or more payable on death (pod) beneficiaries. You can make your account a pod account by instructing us to list each pod beneficiary on the account and complying with the applicable state law.

Bank of America certainly offers POD. Receiving an International Bank Wire Transfer. Most people know they can have a bank account with more than one signer. In this situation, both people have access to the funds in the account.

A beneficiary designation, however, is different. An account owner may name one or more beneficiaries for an account during his or her lifetime. When the account owner passes away, the funds in the account belong to the beneficiary (ies). The beneficiary or beneficiaries must provide notarized letters of instruction in addition to the death certificate. The completed form gives the bank authorization to convert the account.

Be sure to have all account owners sign the letter and tell us how you would like to receive your balance, if any. Press Done after you finish the blank. Now you may print, save, or share the document. Address the Support section or get in touch with our Support team in case you have got any questions. You can also call customer service and they can help you, but they will also need to verify the new person and yourself.

Go to the bank and change the paperwork. Fill out, sign, and deliver to the bank a new account registration card that names a different beneficiary or removes the POD designation altogether. The bank will provide the new account owner with a few additional forms, and them the money is transferred. No waiting for probate. The laws of your state may require a brief waiting period and creditors may have the right to settle final debts.

The name of recipient’s account as it appears on a bank statement. Beneficiary Account Number. However, if the applicable requirements are not met, we may treat your account as though there is no pod beneficiary. During your lifetime, a pod account belongs to you.

You may close the account , remove or add one or more pod beneficiaries , change the account type or ownership, and withdraw all or part of the funds in the account. Unfortunately, some banks (including ING Direct) doesn’t allow account holders to designate beneficiaries. The person designated to receive the funds after the account holder’s death is called a beneficiary. You must record beneficiaries using the financial institution’s official beneficiary designation form, then sign and return the form to the bank for the designations to take effect.

Step Get the social security number and the date of birth of the person you chose as beneficiary to your savings account. You need to get some personal information from them. Most banks and credit unions offer trust accounts , though the most extensive tend to.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.