However, it is not required for tax deductors, tax collectors, Online Information Database Access and Retrieval services (OIDARs), Taxpayers having Unique Identification Number (UIN) and Non-resident taxpayers. It can be applied using two methods - through GST Common Portal directly, or through facilitation centres, also known as GST Suvidha Kendra. You can file for more than one application where in case there is more than one business located in a single state or multiple states. Get your business new GST registration online from the GST official registration website. Check GST return, pay good and service tax, GST filing and takes the help of GST registration Consultant.

GST expert of Online Legal India will help you in every single step to get GST number. Apply for GSTIN from any states of India. How to check GST registration status?

Is GST is good or bad for India? It is expected that GST registration would be provided based on your PAN number. What is gstin number? Another major advantage of GST implementation is that the same GST registration number can be used in all states across India.

Under the current VAT regimen governed by the State Governments, a VAT dealer must obtain VAT registration in each of the State, incurring additional cost and compliance formalities. Why is it important to verify GSTIN or GST Numbers? Verifying GST Number or GSTIN is very important as there are many cases where individuals manipulate GST Number (GSTIN).

Actual fee for registration to GST :NIL. Goods and Service Tax ( GST ) is an indirect tax which is for India on the supply of products and administration. There is no fee described by central government for registration to GST. Existing dealers registered under various act such as VAT,Excise,service tax,customs,Entertainment tax ,lottery etc shall migrate to. The registration process for GST Identification Number is simple.

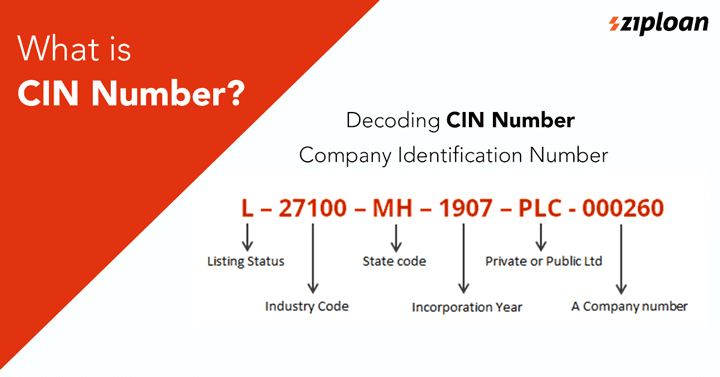

Get GST registration number with the help of GST experts. In GST , the supplier is allotted a 15-digit GST identification number called GSTIN and a certificate of registration incorporating this GSTIN. The first digits of the GSTIN is the state code, next digits are the PAN of the legal entity, the next two digits are for entity code and the last digit is the check sum number. Note that if you start selling any taxable goods you need to register for GST as per GST laws and provide your GST number to Amazon.

GST Registration Online - An Overview. How can I get my GST number online? Where no action is initiated by the Tax Authority within days, the registration application shall be deemed as approved. In this article you will learn GST registration limit and turnover, various types of registrations available in GST for regular, composition dealer etc.

If you are new to GST then you must know the meaning and process of all type of registration available under GST in India. As you are operating through e commerce, you required GST number. For proprietorship business GST registration following documents required. PAN card and Aadhar Card of the individual.

Copy of Cancelled cheque or bank statement. Here is how you can do this: 1. Under GST law, registration of an entity means obtaining a unique number from the concerned tax authorities. This number is referred to as GST Identification Number (GSTIN). Amendment of registration. Where there is any change in any of the particulars furnished in the application for registration in FORM GST REG-or FORM GST REG-or FORM GST REG-or FORM GST REG-or for Unique Identity Number in FORM GST -REG-1 either at the time of obtaining registration or Unique Identity Number or as amended from.

Learn how to register GST online with list of documents required. Benefits of having GST. Share the details on the form above and make payment on next page to get your New Registration and ARN number. The GSTIN number shall come in a few days after the process is complete.

Lodge your Grievance using self-service Help Desk Portal.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.