Your income level is not considered in this case You are a high-income earner who had already purchased a hospital insurance product with a total yearly front-end deductible or excess greater than $5for singles or $0for. You are also eligible if you have had a kidney transplant and are the spouse or dependent children of a person who has worked the required amount of time. If a member and their spouse are both members, a child may be treated as a dependant of only one spouse. We’re aware some users are having trouble opening and using some forms on our site. While we work to fix the issue, you can still access this form by downloading (saving) the form to your desktop and using it from there.

How you download the form to your desktop varies depending on your browser. You must lodge a new declaration if either: 1. If you give the wrong information, you may have a tax debt at the end of the income year. See full list on ato.

However, some people: 1. Refer to Table Ato check if your weekly income qualifies you to either: 1. You need to consider your eligibility for a reduction or an exemption separately. We have two dependent children. We both make just over $90K.

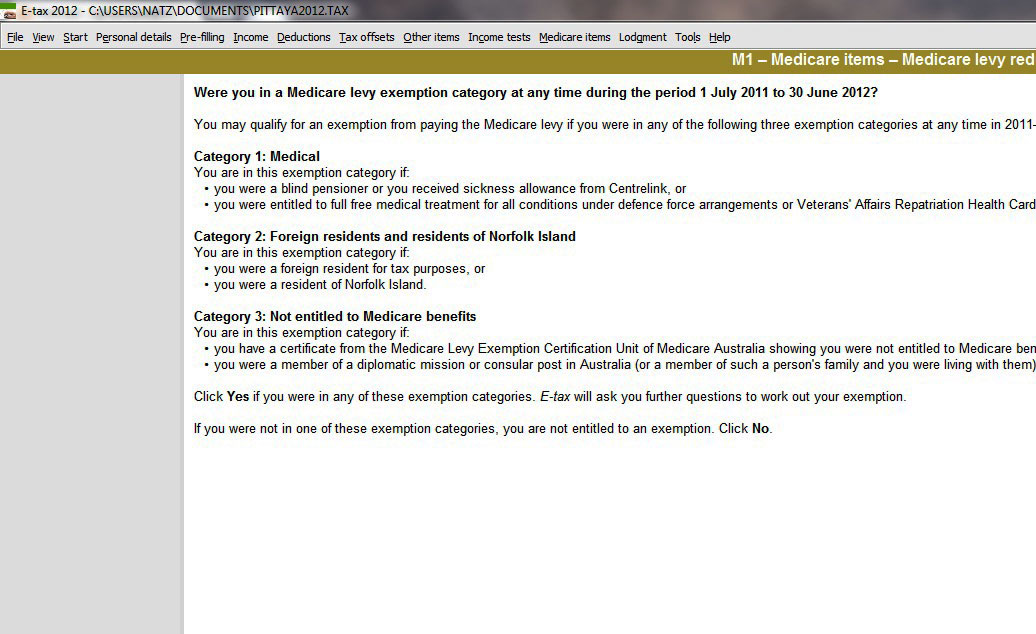

He wants me to take him off our existing family health cover plan and does not w. If your income is below the threshol you may not have to pay it at all. The threshold for singles is increased to $2655. The family threshold is increased to $35plus $3for each dependent child or student. Once you earn over $900 the surcharge amount depends on your income tier. Medicare levy exemption categories 2. A parent is able to claim their child as a dependent for the purposes of medicare levy reduction if they are under and a full time student.

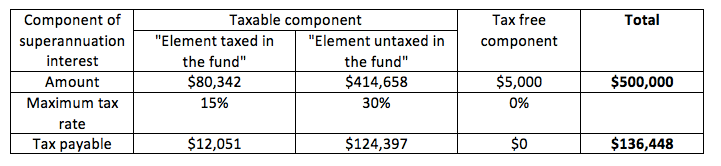

If the child is receiving an allowance from Centrelink this does not impact? The parent is supporting th. This is if the Superannuation is paid directly to your adult children (rather than into your Will). This blog discusses the circumstances when the MLS becomes payable and how private hospital cover can avoid the Surcharge.

The surcharge is calculated at the rate of to 1. For health insurance purposes, dependants are defined as: 1. Up until the age of 2 a dependant who is unmarried and reliant on the policy holder for financial support is considered a ‘child dependant’. Here at Ask Us Tax, we can calculate the partial reduction for you when you lodge your tax return online with us. The ATO advises that while it’s usually , you may pay a reduced rate depending on your income. Generally speaking, there is no simple way to back out. High income earners (see the table below) who don’t have Hospital cover have to pay an extra 1-1.

It applies to an individual and his or her dependants, including spouse or partner. A dependent is any child under 2 or any child or children who are full-time students and under 25. The MLS is paid in any period without Hospital cover.

I am still living at home (23) and am listed as a non-student dependant on my parents private health insurance policy. This is an additional tax that may have to be paid if you exceed the threshold (Singles $90and Families $18000) and don’t have an appropriate level of private patient hospital cover. Considering the overall participation of. Who is Exempt from the 1. If you have two or more dependent children, the family threshold will increase by $5for each dependent child after the first child 2.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.