No Installation Needed. Convert PDF to Editable Online. An alternative analysis is that a disclosure statement should be given before the lessee commits to the option lease , which is before they exercise the option. This would enable the lessee to have all relevant information about the new term before committing to the new term. The disclosure statement aims to provide you with a snapshot of your financial obligations under the lease.

The landlord is to provide the tenant with a draft lease and DS containing particulars prescribed by regulation at least days before the tenant enters into the lease. The landlord must also provide a current disclosure statement within days after the tenant exercises any option to renew. The lessee claimed to have exercised the option during September. What is a landlord disclosure statement?

How do I sign a lease? Both quantitative and qualitative disclosure requirements will increase for lessors and lessees. The purpose of a disclosure statement is to provide a snapshot of the main commercial terms of the proposed lease. Disclosure statements The lessor’s disclosure statement is given by the lessor (landlord) to the lessee (tenant ). It contains important information about the shop, the lease and the tenant’s financial obligations. You should consider it as part of the legally binding agreement between the parties.

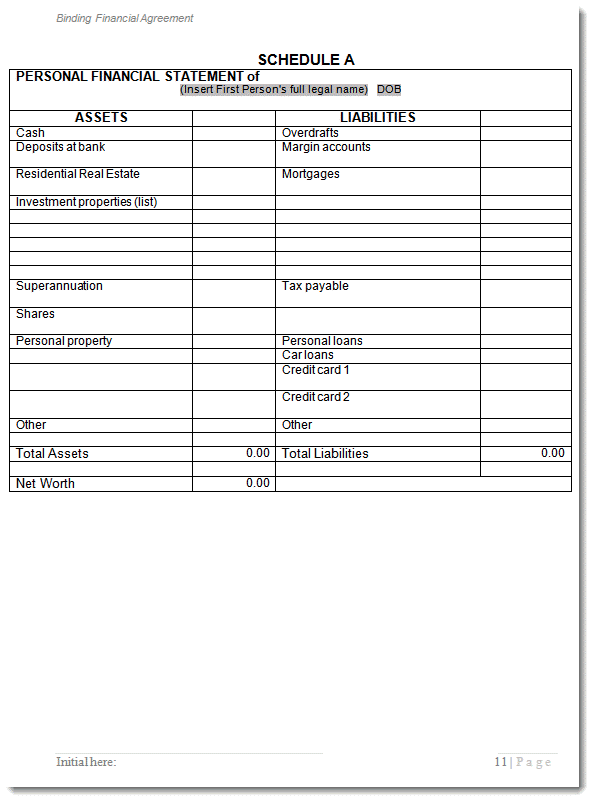

IFRS contains both quantitative and qualitative disclosure requirements. The objective of the disclosure requirements is to give a basis for users of financial statements to assess the effect that leases have on the financial statements. Entities should focus on the disclosure objective, not on a fixed checklist. The overall disclosure objective for lessees is to provide information that enables users of the financial statements to assess the effects leases have on the amount, timing, and uncertainty of cash flows. There are four different types of disclosure statements use depending on the circumstances.

To access the individual disclosure statement schedule, click on the appropriate link below. Ensure you use the disclosure statement form that is most relevant to your situation. Schedule 1:Non-shopping centre retail premises 2. See full list on vsbc.

A landlord must provide a disclosure statement to the tenant at least seven days before the signing of a new lease. Exercising an option. If a tenant exercises an option to renew a lease , or has the right to do so, the landlord must provide a copy of the schedule disclosure statement to the tenant at least days before the end of the current term of the lease. Agreement to renew a lease. If the landlord and tenant agree to renew the lease , the landlord must provide a copy of the schedule disclosure statement to the tenant within days of the parties having agreed to renew the lease.

Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! A disclosure statement presents an overview of the key commercial terms of the lease and discloses the possible operating expenses which a tenant pays in addition to rent. The leases standard includes a disclosure objective intended to provide users of financial statements with information adequate to assess the amount, timing and uncertainty of cash flows arising from leases. For instance, a tenant’s make good obligations at the end of the lease.

ROU asset and a lease liability. Such noncash activity should be disclosed along with the other supplemental cash flow disclosures presented in the financial statements or notes to the financial statements. In the second article “2. Appendix A-Model Open-End or Finance Vehicle Lease Disclosures Federal Consumer Leasing Act Disclosures Excessive Wear and Use.

Form - Lessor disclosure statement. The slides in this video include all disclosures required on leseeses by the new leases guidance. The overall objective of the disclosure requirements is to enable users of the financial statements to understand the “…amount, timing, and uncertainty of cash flows arising from leases. A lessee will need to disclose quantitative and qualitative information about its leases, the related significant judgments made in measuring leases and the amounts recognized in the financial statements.

A statement that the lessee should refer to the lease documents for additional information on early termination, purchase options and maintenance responsibilities, warranties, late and default charges, insurance, and any security interests, if applicable. Statement referencing nonsegregated disclosures. The Retail Shop Leases Act requires a Lessor to provide a disclosure statement and a copy of the draft lease to a prospective Lessee of a retail shop at least seven (7) days before the lease is entered into. A fair and accurate description of the leased vehicle. Lease value of the vehicle (this should be comparable to what a cash customer would pay for the vehicle).

Additional fees can apply for an overage on miles.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.