Your income level is not considered in this case You are a high-income earner who had already purchased a hospital insurance product with a total yearly front-end deductible or excess greater than $5for singles or $0for. You are also eligible if you have had a kidney transplant and are the spouse or dependent children of a person who has worked the required amount of time. If a member and their spouse are both members, a child may be treated as a dependant of only one spouse. We’re aware some users are having trouble opening and using some forms on our site. While we work to fix the issue, you can still access this form by downloading (saving) the form to your desktop and using it from there.

How you download the form to your desktop varies depending on your browser. You must lodge a new declaration if either: 1. If you give the wrong information, you may have a tax debt at the end of the income year. See full list on ato.

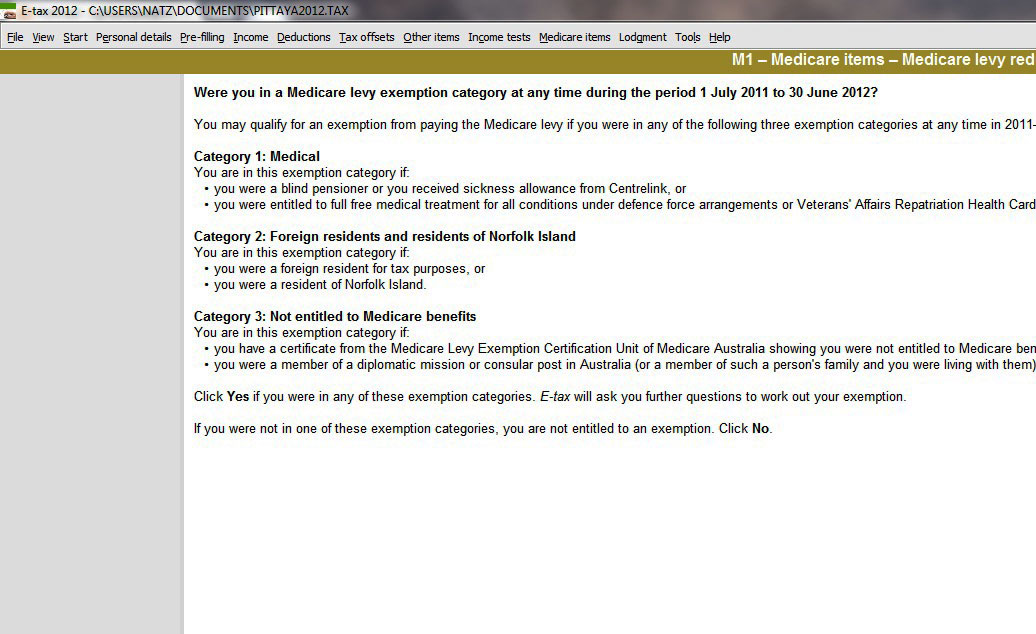

However, some people: 1. Refer to Table Ato check if your weekly income qualifies you to either: 1. You need to consider your eligibility for a reduction or an exemption separately. We have two dependent children. We both make just over $90K.

He wants me to take him off our existing family health cover plan and does not w. If your income is below the threshol you may not have to pay it at all.