Federal Income Tax ). Upon completion of this course , you should have a good understanding of: 1. The objectives of the U. Certificate inTaxation 4. CBusiness Management 4. CEconomics and Financial Mathematics 4. CAccountancy For Tax Practitioners 4. CLaw For Tax Practitioners 4. Diploma in Taxation 4. AC 3at University of Dar es salaam. Professor William Kratzke teaches tax law courses at the University of Memphis. He has taught courses across the curriculum. In addition to tax courses , he has taught trademarks, torts, civil pro-cedure, world trade law, economic analysis, and other courses. In contrast, traditional tax accounting course note concentrate on administrative issues while ignoring the richness of the context in which tax factors operate.

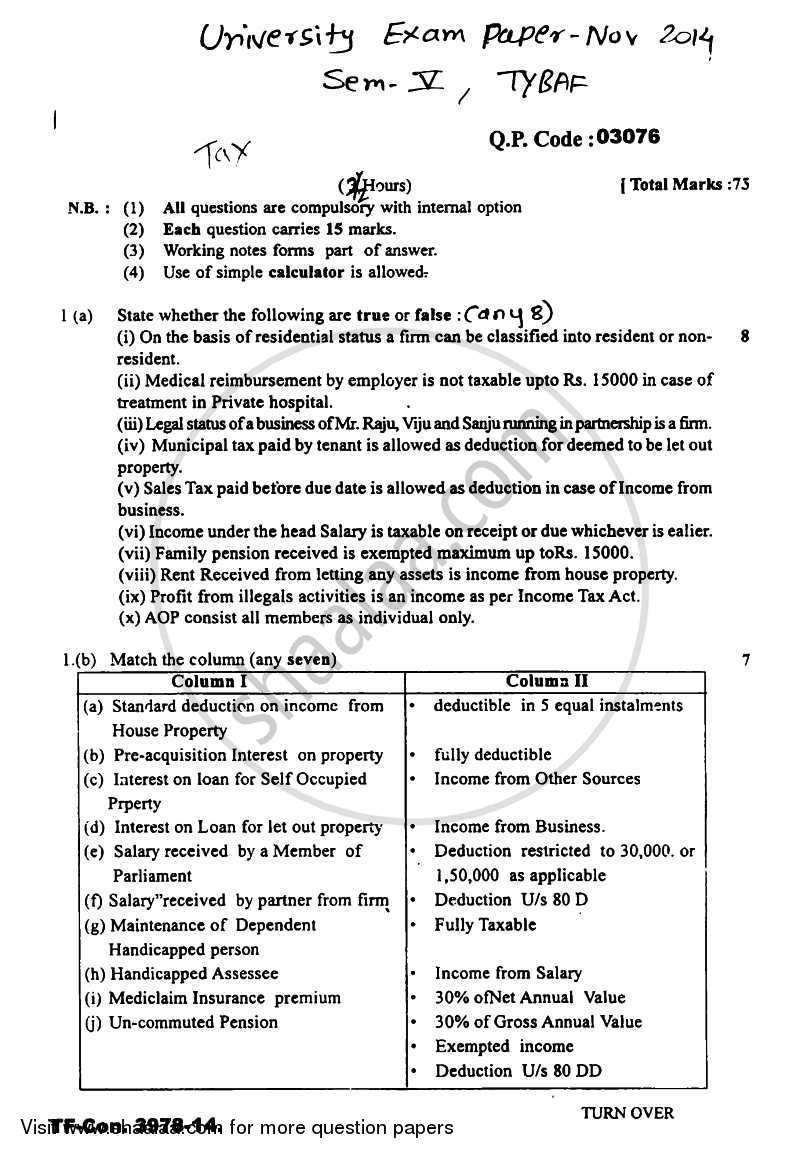

DA10- Taxation Learning Outcomes On successful completion of D1 students should be able to: Describe the principles of taxation and explain the role played by taxation in the economy Identify and respond appropriately to ethical issues arising in the course of performing tax work Explain the administrative procedures for direct taxes, including objections and appeals procedure Calculate. Read it with the goal of gaining a broad understanding of tax purposes and principles. Although the history is interesting, for Unit 01.

This is an overview chapter. View MODULE - CORPORATE TAXATION. LAW 3at Walden University. Students are expected to gain knowledge on the legal frame work within which taxation of incomes is administered. About the Comprehensive Tax Course.

Modules, Chapters each (hours of CE) No prerequisites required. California edition is CTEC. Enrolled Agents and other tax return preparers are able to earn continuing education (C.E.) credit by successfully completing one of Jackson Hewitt ’s intermediate-level tax courses. Gabriela De Remedios TAXATION I 2-Art.

TFEU: “Save as otherwise provided in the Treaties, any aid granted by a Member State or through State resources in any form whatsoever which distorts or threatens to distort competition by favoring certain undertakings or the production of certain goods shall, in so far as it affects trade between Member States, be incompatible with the internal. Master Tax Guide PRE-ORDER TODAY! Semester, Subject and the lecture, Word count etc. There are thousands of TCE site locations across the U. Best of all you will receive feedback on any missed questions and can return to the free tax course at your convenience within the six month duration of the course. Access IRS Tax Forms.

Topics will include the definition of gross i ncome, exclusions from gross income, the requirements for various tax deductions, timing issues, and cap ital gains and losses. A tax can either be proportional, progressive or regressive. Proportional Tax (Flat Tax ): A proportional tax is a tax whose burden is the same rate regardless of the income earned by the household.

Business Taxation Syllabus. Introduction Overview Welcome to Taxation II! Tax Avoidance, Evasion, and Administration Abstract Tax avoidance and evasion are pervasive in all countries, and tax structures are undoubtedly skewed by this reality. Principles of taxation.

Standard models of taxation and their conclusions must reflect these realities. Tax planning is an important area as far as the fiscal management of a company is concerned. International Online Tax Courses are carefully crafted on the basis of the theoretical and practical experience of international tax experts.

These courses are designed to help broaden knowledge on issues involving cross-border taxation and provide a flexible, high-quality and -oriented training to tax professionals anywhere in the world.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.