What are the requirements to take the CPA exam? How to become a CPA, requirement for the CPA exam? Where should you apply to take the CPA exam? Residency Requirement.

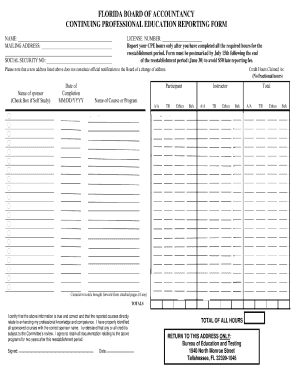

Minimum Age to Sit for the CPA. Florida Applying for the Uniform CPA Examination. Florida’s general requirements for its CPAs are pretty straightforward and on the same scope with those of many other states. All first-time candidates are to submit the. It requires a total of 1semester hours in undergraduate coursework, which will enable you to sit for the CPA exam.

See full list on accounting-education. Your school must be fully accredited by a regional accreditation board. If you did not graduate from an accredited college or university, you can still sit for the exam. Once your application has been approve you will receive a Notice to Schedule.

Upon receipt of this notice, you will have six months to apply and sit for your first portion of the CPA exam. Note that if you fail to schedule an exam time within six months of the Notice to Schedule, you will need to apply again. Once you have passed all four parts of your CPA exam , you are ready to apply your accounting skills as an employee. The Board requires 0hours of work experience, completed over either or 1weeks.

During this time, you are allowed reasonable sick and vacation time. You may take all four exam. Your experience must cover one or more of the following areas: 1. Financial Advising 5. ConsultationYour supervisor must sign off on your experience with a Verificat. However, in order to obtain your CPA License, you must complete additional requirements as stated below.

Additional fees will be required by the testing vendor when you schedule your exam. Apply to Sit for the CPA Exam and Pay the. Work Experience Requirement. One year of work experience under the supervision of a licensed CPA. This is especially true since CPA Exam requirements vary by state.

One thing to keep in mind is that there are two routes CPA Exam candidates can go through when they’re applying to the CPA ExaState Boards of Accountancy, or NASBA (National Association of State Boards of Accountancy). Guam, Northern Mariana Islands, Puerto Rico, U. Virgin Islands, and Washington D. Age requirements to become a CPA Most states and territories don’t have minimum age requirements to take the CPA Exam. To obtain the required body of knowledge and to develop the skills and abilities needed to be successful CPAs, students should complete 1semester hours of education. All state boards of accountancy – with the exception of the U. This rule ensures that all CPA exam candidates have a total of 1semester hours of education under their belts before they sit for the exam. Instant Certificates, NASBA QAS Approved.

Save Time and Money, Available Nationwide. Limited Time $Discount, Subscribe Today! Currently have or working towards a 1semester hour degree (ex. BMAcc or Master’s Degree in accounting or business) Over the age of 18.

All states require a bachelor’s degree in accounting with at least 1credit hours of coursework to become a licensed CPA. Some states will let you sit for the CPA Exam with 1hours of study, though you still must complete 1hours before you can apply for a license (these are called two-tier states). Educational requirements to become a CPA.

Find Colleges With Convenient Online CPA Exam Prep Courses.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.