What is the easiest state to become a CPA? Check out AICPA’s “This Way to CPA Check out the California Board of Accountancy’s Educational Requirements. Residency Requirement.

Minimum Age to Sit for the. The Certified Public Accountant certification is one of the most prestigious professional certifications available. It indicates that the accountant has satisfied a demanding set of educational, professional, and ethical standards.

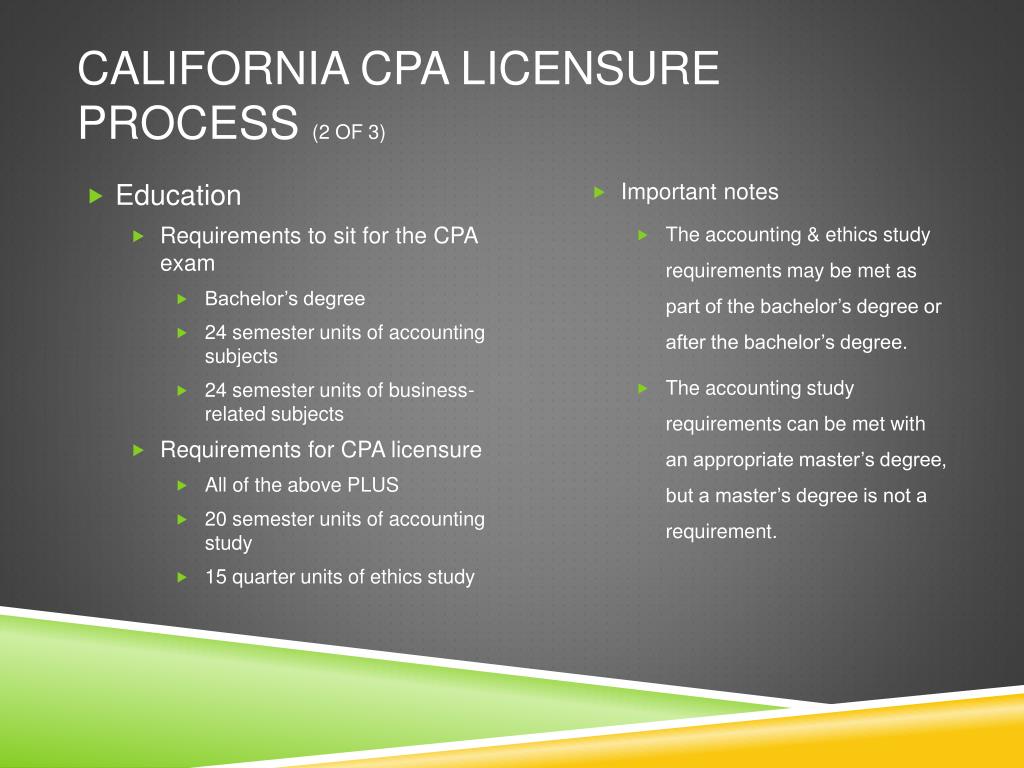

Before candidates can sit for the exam, they must satisfy their state’s requirements and qualifications. Below we will be discussing the requirements for the state of California. The state requires a bachelor’s degree or higher from a nationally or regionally. See full list on cpaexam. Review Courses have been preparing accounting professionals to pass the exam for years.

In other words, they are a worthy investment. First-time California exam candidates must create a client account with the CBA. Once the account is active, candidates can submit an application and remit the required $1application fee. Re- exam candidates do not need to create a new client account, but they must remit a $re- exam application fee each time they reapply. All application fees are nonrefundable and must be paid by check or money order directly to the CBA.

Along with the application and the fee, first-time candidates must submit official transcript(s) to the CBA that show the educational requirements have been met. Re-exam candidates only need to submit the re-exam application fee. Candidates can check the status of their application by accessing their client account through the CBA website.

The CBA will then submit an Authorization to Test (ATT) request to the National Association of State Boards of Accountancy (NASBA). Once processing is complete, NASBA will send the candidate a payment coupon, which is valid for days. After days, the ATT and payment coupon will expire if payment has not been remitted.

Once payment is remitted to NASBA, candidates cannot add or remove exam sections. Upon successful state application, candidates will receive a Notice to Schedule (NTS), which is valid for one testing event or six months, whichever comes first. The NTS lists the section(s) that the candidate is approved to take, as well as the deadline for testing. An examination appointment cannot be scheduled without a valid NTS.

Once candidates receive their NTS, they can then contact Prometric to schedule the examination. All scheduling, rescheduling, or cancellation of testing appointments is done through Prometric. Testing windows are as follows: 1. Auditing and Attestation (AUD): $208. Business Environment and Concepts (BEC): $208.

Financial Accounting and Reporting (FAR): $208. Regulation (REG): $208. Upon completing each section of the exam, candidates can obtain their scores online once NASBA has released the information.

They can also elect to have exam scores mailed to them. As part of these 1hours, you must have hours of accounting subjects, hours of business subjects, hours of accounting study subjects, and units of ethics. The hours of accounting subjects include these areas of study: 1. External or Internal Reporting 4. This is a standardized test administered through the American Institute of Certified Public Accountants (AICPA) and includes four parts: 1. Keep in mind that many people need to retake the. You must have full months of experience in accounting, attest, compilation, management advisory, financial advisory, taxes or consultation.

Your experience may take place in any type of accounting firm, whether public, private or governmental. The Board will need a Certificate of General Experience (CGE) form filled out by your supervisor. There are separate forms for either public or private acco. This test must be completed and passed within two years of your application for a license.

Philosophy of professional conduct 3. Code of Professional Conduct 4. Independence, integrity and objectivity 5. You must pass the multiple-choice question test with at least a percent or higher. The exam and its study materials cost $1and can be purchased from the CBA. In order to become licensed as a CPA, California requires applicants to complete prescribed work experience.

You must complete months of general accounting experience and 5hours of attest experience. Learn about how the CBA continues to serve the public during the COVID-pandemic. Read a statement from CBA President Nancy J. Submit all the required paperwork to the state board usually includes transcripts, license application, and.

Education Requirements. Credit Requirements : 1semester units. Requirements may vary. Always consult with your state or jurisdiction's board of accountancy for the most current information.

Request Free Info From Schools and Choose the One That's Right For You. CPA Exam Requirements.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.