What is the easiest state to become a CPA? What are the requirements to take the CPA exam? Can a CPA work in any state? Should I sit for the CPA exam? Guam, Northern Mariana Islands, Puerto Rico, U. Virgin Islands, and Washington D. See full list on beatthecpa.

CPA Exam Requirements by State. Some states also require residency or citizenship. The Uniform Certified Public Accounting Exam is developed by the AICPA and administered at.

Meet the Work Experience. Educational Requirements. This means that candidates have to wait until they have completed all of the necessary educational requirements, which can take several months.

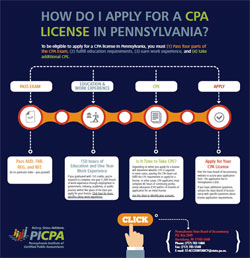

Learn more about educational requirements. Not only do you have to follow a set protocol for submitting all your information and fee payments to ensure that you’re eligible , but you also have to wait in most cases to finish meeting these requirements before. Steps to take the CPA exam. Each state has its own set of requirements for licensure.

If you have questions regarding meeting the education requirements to be eligible to take the CPA exam , please contact CPAES. Credits can be obtained within or beyond a degree program. One year of experience (7hours) working under a CPA whose active license is from NJ or from a state that is substantially equivalent to NJ. Currently all states are substantially equivalent.

Complete the electronic fingerprint process for a background check of the criminal history files of the Texas Department of Public Safety (DPS) and the Federal Bureau of Investigation (FBI). Everything else about the process varies by state. These CPA requirements vary wildly from state to state.

They cover educational requirements , such as how many credit hours are needed and in what specific courses, as well as the state experience requirements. Illinois is one of the strictest states as far as qualifications to take the exam for the first time. IL requires you to have a bachelor’s degree as well as all 1credit hours completed before you are even eligible to apply to take the CPA exam. They also have quite detailed instructions for what makes up the 1credit hour requirement.

Eligibility for Examination. Accounting and Business classes must be completed with a grade of “C” or above. It also protects the public interest by ensuring that only qualified individuals become licensed as CPAs. You must meet the following qualifications to take the CPA exam.

Hold a baccalaureate or higher degree from a board-recognized United States college or university, or an equivalent degree as determined by board rule from an institution of higher. In some states , passing the ethics exam will even count toward your annual CPE requirement. To find out your state ’s ethics exam requirements , you may need to check the state board of accountancy.

Ethics Requirements by State. Many states have mandate similar education qualifications, but there isn’t a consistent rule that all states follow. How to Become a CPA in Each State. This is primarily because the federal government has never controlled the Certified Public Accountant.

It is the candidates’ responsibility to know the CPA exam requirements of their state. This condition is required to be met in precisely the same manner in each of the 55. Passing the Uniform CPA examination. Although licensing requirements vary from state to state , and eligibility to sit for the exam depends on the requirements set forth by the state board of accountancy, the CPA exam is identical, regardless of the state or jurisdiction.

All jurisdictions require applicants to meet specific educational requirements prior to sitting for the Uniform CPA examination, although not all jurisdictions require the completion of the 150-semester hours required to become licensed. A CPA license from your state will put you at the very top of the profession. CPAs command some of the top-tier positions and best salaries in business. We’ll explain all the steps to becoming a CPA in Washington State. General Requirements.

CPA License Requirements Pass the Exam. Submit all the required paperwork to the state board usually includes transcripts, license application, and. Pay the applicable license fees. The basic requirements of any state involve academics, an examination and experience. You will need 1semester hours of academic credit from an accredited institution for your license, but 1will suffice to sit for the CPA exam.

On that test, you must pass all four parts with a minimum score of 75.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.