Franchise Tax Definition - investopedia. What is franchise tax? Are general partnerships subject to franchise tax? File a return, make a payment, or check your refund. to your MyFTB account.

Follow the links to popular topics, online services. Tax prep franchises also provide peace-of-mind to their customers. When an individual signs a tax return, it means he or she is on the hook for any questions the government might have – even years down the road. By using a tax pro, like a franchise, individuals can have a buffer between them and the IRS. Some entities are exempt from franchise taxes including fraternal organizations, nonprofits, and some.

This helps us get to know you, and curate the best opportunity that fits your lifestyle. The Texas franchise tax is a privilege tax imposed on each taxable entityformed or organized in Texas or doing businessin Texas. The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee. The excise tax is based on net earnings or income for the tax year. Corporations are taxed $1.

Foreign corporations are additionally assessed $1per year, payable to the Oklahoma Tax Commission, for the Secretary of State acting as their registered agent. Learn about the Charitable Gifts Trust Fund. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now!

Search franchise by location, category, capital requirement and more! Marketing support and built-in brand awareness and processes ensure that you get up and running, positioned for success. Failure to pay franchise taxes can result in a business becoming disqualified from doing business in a state. As a franchisee, you can get the latest insights, trends and information about taxes through the Tax Institute at HR Block.

Your team will have access to over 0articles, FAQ’s, case studies, receive help researching and resolving tough tax questions, and much more. The NCDOR is committed to helping taxpayers comply with tax laws in order to fund public services benefiting the people of North Carolina. Reminder: July is Deadline to File Personal Income Tax Returns. This makes tax franchises an excellent option for entrepreneurs looking to open their own business.

An estimated of tax filers in the U. Guiding them through this process, as painlessly as possible, is the role of an income tax franchise. If you like the idea of using your know-how of taxes and finances to help others, this is a great business option. The upfront franchise fee is not immediately deductible for tax purposes because it relates to an intangible asset with a useful life that extends beyond the current year. Accordingly, the fee is amortized over years. For individual income, corporate income and franchise , fiduciary income, partnership, and partnership composite tax returns and payments due between Aug.

Withholding, sales, severance and excise tax returns and payments due between Aug. Working within a franchise system provides you with marketing and training assistance, so you can focus on providing the best possible tax preparation to your clients. Although this is a challenging fiel it is one that demonstrates an ongoing nee as Americans seek assistance in filing their annual taxes. There are many advantages to owning a Income Tax franchise.

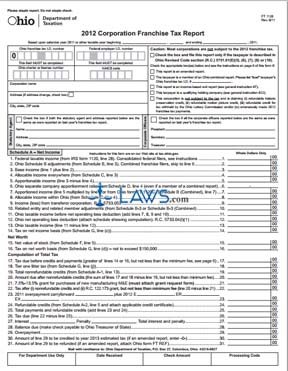

Starting your own business can be tough. Thanks for visiting our site. The Ohio Department of Taxation is dedicated to providing quality and responsive service to you, our individual and business taxpayers, our state and local governments, and the tax practitioners in Ohio.

Our goal is to help make your every experience with our team and Ohio’s tax system a success. The Alabama Department of Revenue has developed B. TRD offices are open by appointment only. The status of a refund is available electronically.

A social security number and the amount of the refund due are required to check on the status.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.