Such letters are traditionally drafted by third-party institutions like. Any Notice of Indemnity sent by the Indemnitee to the Indemnifier must be made in writing and contain a full listing of the items to be covered in the payment. Any payment made by the Indemnifier to the Indemnitee will contain a listing of items covered under the payment.

In the title industry, a hold harmless letter is an indemnity agreement between two title insurance underwriters wherein one underwriter agrees to indemnify the other for any claim that may arise out of a particular title defect on a particular piece of property. Each underwriter has its own form for hold harmless letters. What is a letter of indemnity for a bank? Why do we have real estate indemnity agreements?

While a real estate indemnity agreement may have a scary or intimidating sounding name, it is a very common and very simple type of legal agreement. With a real estate indemnity agreement , one party is pledging to protect another from any kind of financial loss or from a lawsuit of some kind. We often hear about an indemnity agreement when we are filling out our car insurance forms, but this type of agreement is commonplace in most other forms of law.

If a business has a loss on a piece of property and the insurance company has agreed to pay the claim, the insurance company may write a letter of indemnity to the lender assuring that the insurance proceeds will go towards the repair of the property. Lets look at an example or two. The indemnification obligations of Buyer shall be repeated at and shall survive the Closing. After this decision is made, a statement indicating the binding status of the document should be incorporated into the language of the form. Without such a written declaration, it will be far more challenging to enforce the validity of the agreement in court, and the case would likely be dismissed due to the uncertainty of the letter’s intent.

See full list on eforms. The buyer or tenant will visit the property to evaluate the premises and determine whether the space suits their real estate needs. If the buyer or tenant chooses to proceed with the transaction after assessing the property, they should immediately complete a letter of intent and present it to the owner for review. This letter offers a general description of the proposed real estate transaction including the desired financial terms and completion dates. Negotiations between the parties will likely continue if the owner is not satisfied with the initial offer.

Once the real estate conditions have been successfully negotiate a binding contract should be drafted and carefully reviewed by each party. The document used at this time will either be a purchase agreement or a lease depending on the nature of the relationship between the parties. For purchase agreements, the parties may wish to have a lawyer examine the contract before entering into an officially binding contract. However, for leases, the transaction will be finalized once the parties sign.

Purchase agreements typically contain a clause that grants the buyer a specified amount of time during which they can perform a proper inspection of the premises. If the property fails to meet their standards, the buyer can usually back out of the agreement or negotiate new terms with the owner. The inspection should be performed by a qualified professional as they can more easily spot issues that might affect the value of the property going forward.

If the buyer is satisfied with the inspection , or if no inspection is performed during the inspection perio the buyer’s offer will be accepte and the property shall be transferred to their name following the closing period. The closing is a predetermined date when ownership of the property is officially transferred to the buyer. Depending on the state where the property resides, the parties may need to meet in person along with various entities (e.g., notary, escrow company, titling insurance agent) to complete the transaction, or they may be able to conclude the process separately. Regardless of the closing metho it will always involve the parties signing the necessary paperwork and paying the fees associated with the transfer of ownership. Real Estate , Family Law, Estate Planning, Business Forms and Power of Attorney Forms.

Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Often a letter of indemnity is written by a third party, often a bank or insurance company. These letters are also common within real estate and insurance. In the case that a property is damaged and the policy holder makes an insurance claim, the letter assures the mortgage provider that any payouts will go towards restoring the property and maintaining its market value.

Real Estate with any party other than Buyer unless either (1) Buyer and Seller fail to enter into a binding Purchase Agreement by HOURS from the time of acceptance of this agreement, or (2) Buyer and Seller agree in writing to abandon this Letter of Intent. This section is intended for Real Estate Agent and Title Company commercial use. The purpose of a letter of intent is to get both parties to come to a non-binding agreement over the terms of a sale or lease.

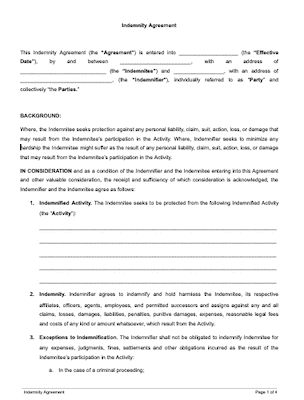

Sample Indemnity Agreement. More than just a template, our step-by-step interview process makes it easy to create an Indemnity Agreement. Save, sign, print, and download your document when you are done. This form of a Release Agreement, Indemnity Agreement and Hold Harmless Agreement releases a party from certain specified liabilities.

Releases are used to transfer risk from one party to another and protect against the released party or reimburse the released party for damage, injury, or loss.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.