A publication that provides payment rate information for Centrelink payments. A list of Centrelink payments and services available from Services Australia. To get JobSeeker Payment you need to meet some rules.

To find out the full conditions and if this payment is right for you, read who can get it. The JobKeeper Payment can affect Centrelink payments. Read about if you get. Your maximum payment rate each fortnight includes JobSeeker Payment and the Coronavirus Supplement.

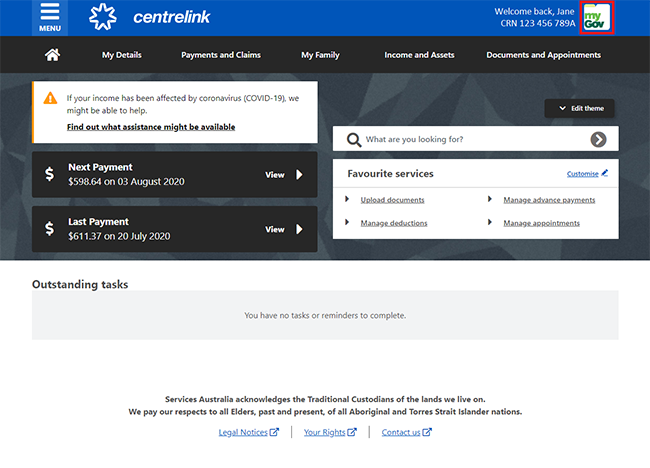

Your payment will change back to just JobSeeker Payment when the supplement stops. The MyGov website crashed on Monday morning after thousands of people tried to access Centrelink payments. We are testing a new translation tool to make our website more accessible. As this is a trail, there might be inaccuracies on the translated pages.

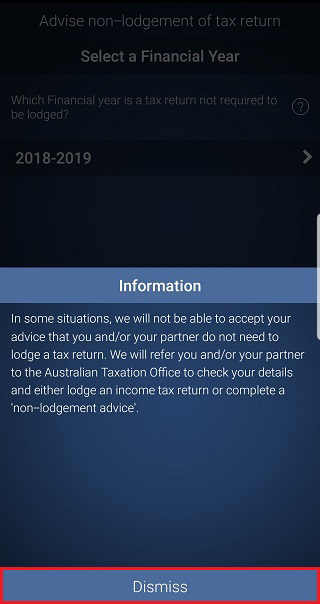

And you cannot access Centrelink payments at the same time as receiving annual leave, sick leave or income protection insurance. The balance of the amount for emergency and general assistance payments shown on your Centrelink PAYG payment summary, go to Australian Government special payments. Completing this section.

Login into MyGov, select “Link Your First. The class action will also determine whether the Centrelink levied fees should be refunded. You must take the Flexible Paid Parental Leave days before your child turns 2. Centrelink Payment Rates The current Centrelink Payment rates and related qualifying information is available in a booklet published by the Department of Human Services, linked below. These make up payable days. The government will hand out cash payments of $5in a bid to prevent a recession as coronavirus hammers the economy, it has been reported.

Prime Minister Scott Morrison is due to announce a range. Woman with disabilities has $92k Centrelink debt after misreporting for years. Some Centrelink payments can be automatically suspended after days overseas. To be able to receive the Upfront Payment you must be eligible for Family Tax Benefit Part A and must not be receiving Parental Leave Pay for the same child. This amount is not taxable.

Services Australia said people who are currently receiving Centrelink payments and were eligible for a refund would receive a notification on their online account. At the time, Treasurer Josh Frydenberg said he was hopeful the. A choice between community support and poverty-level Centrelink payments Opinion.

As COVID-restrictions slowly lift and borders begin to reopen, emergency payments and increased benefits introduced to mitigate economic and social damage are about to be wound back. In a position where some extra cash could help you out if you’re receiving Centrelink payments , you might find yourself. Centrelink itself possesses advance re payments , but then Jacaranda Finance may be able to help if you’re looking for a fast personal loan!

Merely check if you qualify, type and why don’t we perform some sleep! The new payment will combine seven payments into one, Social Services Minister Anne Ruston stated. Eligible tenants will receive $607. Parenting Payment The main payment available to single parents is a Centrelink Parenting Payment , which you can access if you are the principal carer of a child younger than eight if you are single and a child younger than six if you have a partner.

There are also other criteria you need to meet. Centrelink says the supplement will be paid to eligible customers from July this year, after their family assistance payments are balanced. Freeze on income limits. The changes to Centrelink reporting are expected to save the federal budget $2. Gone are the days of people reporting income to Centrelink by estimating pay amounts based on how many hours worked in a fortnight and rate of pay , taking into account penalty rates.

The Department maintains previous Indexation Rates. Austudy - a payment for full-time students and Australian apprentices aged years and older.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.