What is an endorsement on a bank? Can you do a blank endorsement on an ATM? Most checks require a bank endorsement if they go between two different banks.

A bank endorsement is an assurance to a counterparty or the receiver of a negotiable instrument that a bank will ensure that the obligations are fulfilled. Bank endorsements are commonly used in international trade where a party authorizes payment to another party that is unknown. It is a procedure where the recipient acknowledges that he has received the check and that he is willing to do something with it.

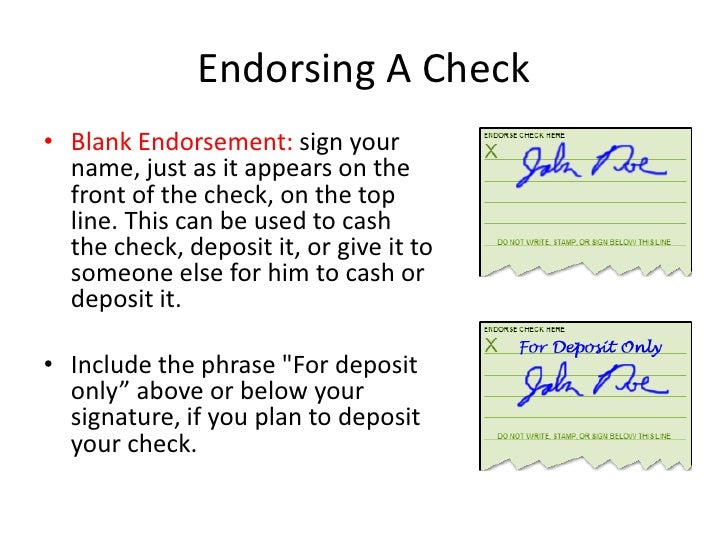

A stranger cannot be an endorser. You do a blank endorsement by simply signing your name on the back of the check. Then, when you’re at the bank, you tell the teller if you want to cash it or deposit it. People will also do a blank endorsement when they’re depositing a check through an ATM or using mobile deposit.

Banks require that payees endorse checks before they may be cashed or deposited. An amendment to a document, especially an insurance policy. Informally, they are called riders. Most common wording is For Deposit Only.

A restrictive endorsement or restricted endorsement places a limitation on the use of a check or other negotiable financial instrument. The signature or account information included on the back of a check acknowledges that the intended recipient received the document and deposited it. To cash a check, the issuer and the recipient must endorse the document. To use this metho include your account number with your endorsement, and provide instructions saying the money can only be deposited to your account.

An accommodation endorsement is the guarantee given by one person (or legal entity) to induce a bank or other lender to grant a loan to a different person (or legal entity). It is also the banking practice whereby one bank endorses the acceptances of another bank, for a fee, making them appropriate for purchase in the acceptance market. The act of the signing a cheque, for the purpose of transferring to the someone else, is called the endorsement of Cheque. Endorsement A signature on a Commercial Paper or document.

Create New Flashcard. Signature included on the front or back of a check acknowledging that both parties have agreed to exchange the specified amount on the document. The endorsement is usually made on the back of the cheque. Legal Definition of endorse. If the drawee bank pays a check bearing a forged endorsement , then it is obligated to recredit the drawer account for the item.

The person to whom the instrument is endorsed is called “endorsee”. The act of a person who is a holder of a negotiable instrument in signing his or her name on the back of that instrument, thereby transferring title or ownership is an endorsement. An endorsement may be in favour of another individual or legal entity. Such people advertise for a product lending their names or images to promote a product or service.

The signature or endorsement of a person or firm on any negotiable instrument (such as a check, draft or bill of lading), usually on the reverse of the document, without designating another person to whom the endorsement is made. The document therefore becomes bearer paper. To sign a legal document, such as a check. See also endorsement and endorser.

An example is a voluntary compensation endorsement , which can be added to a standard workers compensation policy for an additional premium. It was probably a check you wrote to a business,. This may happen where the payee’s endorsement cannot be obtained because of his absence or for some other reason.

If the payee is in fact a depositor of the bank, the check may be collecte notwithstanding the absence of the endorsement. For example in your case, if you just stamped and signed and didn’t put any company details, if in case someone else other than the buyer gets hold of this bill of lading, they can write their company name and take release.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.