Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Financial , for Mortgage, for. How to write a hardship letter to a creditor? How not to write a hardship letter?

When you should write a hardship letter? Typically, lenders spend less than five minutes reading a hardship letter so it’s in your. Explain your situation.

In a financial hardship letter , you need to explain why you stopped making mortgage payments. Keep your request specific. The most recognized reasons for why financial hardship letters are written are the following: the inability to settle loan terms , and the incapacity to pay medical bills.

The best letters read like an attorney’s pleading. They establish facts in a way as to convince a mortgage lender to grant a short sale or loan modification instead of a foreclosure. The letter can be sent to a person or organisation to whom repayments are owed (such as a bank or other lender) (the Receiver). Lenders may use them to determine whether or not to offer relief through reduce deferre or suspended payments.

It’s different from a promissory note in the sense that you are requesting for a loan modification or adjustments in your current payment plan. The purpose of the letter is to describe why the borrower may not be able to make their mortgage, car loan, or other debt payments. It is important that you include actual examples of hardship and any plans you have for the future.

Types of hardship letters. Data, Collaborate, Sign, and. No Installation Needed. When writing the starting a hardship letter, it’s best to make a timeline of. Inform the financial.

How To Write a Debt Hardship Letter Step 1: Identify What’s Causing the Hardship. Before you can start writing the letter, you need to have a clear picture. Step 2: Provide a Description of the Hardship. There is always a backstory to everything.

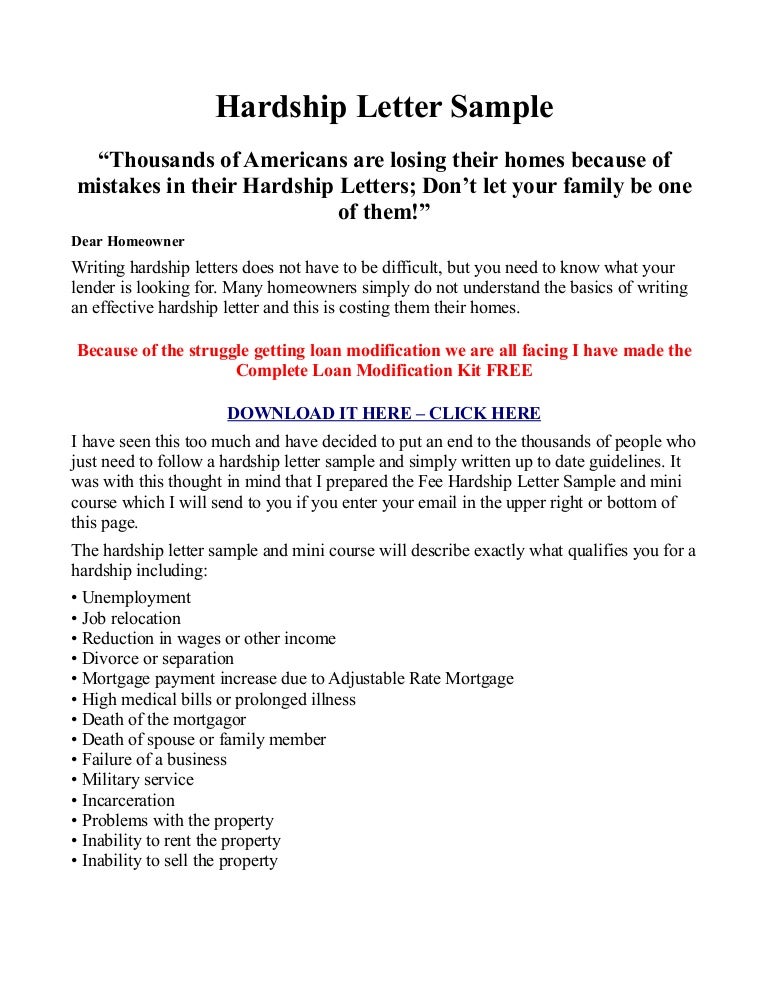

You can try and narrate in the. Here’s a few situations that do qualify: Unemployment Change in income Pay cut Partner losing their job A new, lower-paying job Pay cut Partner losing their job A new, lower-paying job A job transfer Incarceration Military duty Illness or medical emergency An interest rate hike in an adjustable-rate. State Your Reason Step 2. This letter explains to the lender your present circumstances, your efforts to get out of the circumstance, and your inability to come out of the situation.

Very simply put, this is a letter written to a creditor, in which special consideration is requested because of a certain situation. This means that you are struggling with your finances due to a situation beyond your control. One way to get the ball rolling, is by writing a hardship letter. A hardship letter is used to request a temporary reduction or suspension of payments due to financial hardship. However, this does not mean that you have to pay more than you can, nor do you have to take out a loan.

Do not write pages explaining your hardship. Make the letter concise. You need to describe the steps you have taken in response to the difficulty. Many creditors require a hardship letter when the borrower requests financial assistance or alternative payment options. Hardship letters provide you with an opportunity to appeal to the mortgage company and convince the lender to give you another chance.

Step Place your name, address, mortgage holder and loan number at the very top of the document to make it easier for your reviewer (s) to know exactly who you are. A financial hardship letter to mortgage companies or banks is a letter you send to your financial institution explaining why you are no longer able to make the payments on your house and indicate exactly what happened to cause your payments to fall behind. This letter is a key document in the effort to avoid foreclosure and outlines the issues that are affecting your ability to pay your mortgage.

Use our free sample letter of hardship template to help you get started. This kind of letters is sent when the business is in loss or isn’t able to come back to normal level of productivity. Not everything qualifies as a bona fide financial hardship. Questions your hardship letter should answer.

The people who read your hardship letter come to it with questions they. I would include an explanation of what has changed in your financial.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.