How do you write an authorization letter? What is a bank account verification letter? Letter of authorization for the Bank account is a very commonly used letter which is widely used in the current scenario. An authorization letter for bank is a letter written to the Bank by an owner or a Signatory of a bank account to allow the bank do transactions on the account.

If you wish to grant a power of attorney to a third party to manage your bank account , you must write a letter and send it to your banker. The purpose of writing this letter may vary with, case to case. Some write it to allow their family members or business partners to do monetary transactions while others draft such letters to operate their closed bank accounts.

At times when you cannot personally make transaction with your bank , you can request someone to do the task for you. Authorization letters would also give details with regard to the tasks needed to be accomplished by the proxy. There are several types of banking authorization letters.

Some are sent from the bank to other individuals while some others are addressed by people to the bank. A Bank authorization letter in the simple straight forward words is the one, in which a specific person is authorized by the owner or the signatory of the bank account to transact the various kinds of the transactions. If you wish to avoid all of this, simply transfer a certain amount of cash into a special account, and make it a joint account. Add your appointed representative as a co-owner of the account.

This way, they’ll be able to handle transactions and no letter will be necessary. Whether you are empowering your appointed representative to have access to one account at one bank , or several accounts at different banks, it is important that you first contact each financial institution, to inquire if they have special forms to fill out. If your financial institution does not have a form, simply write the authorization letter yourself. See full list on wordtemplatesonline. I will be out of town for an extended business.

Thank you for your kind attention to t. Since this is considered a legal document, it should always be typed in an acceptable business letter format, such as a blocked style. Here, all the information you include will be justified to the left, with no indentations, single-space and spaces in between sections. Check with your state requirements, as you may need to have this letter notarized. This letter should always be type and never hand-written. Keep the letter business-like in tone, short and concise.

Never leave room for anyone to make their own interpretations. Name all accounts they are to have access to, and name all transactions, accounts, safety deposit boxes, they are not allowed to have access to, if any. It’s never easy to realize that you’ll need to compose one of these letters. However, as these are your finances, you must do so and do it with a clear and level head.

In other words, don’t be afraid to place limits on what the individual can do. Feel free to contact your lawyer as well, to inform him or her of the FPOA. With all precautions taken, you should be able to have peace of min knowing your finances will be taken care of in the proper manner, as you requested.

Along with sending medical records other legal documents may need to be transferred between lawyers and doctors in the case of a personal injury claim, divorce action or a lawsuit. If a person is going on vacation, they may want to allow a friend or family member access to their bank account to pay bills. According to the law, the third party’s actions are binding for the first party. The letter is written by the first party to the second party and.

The first party is responsible for anything the third party does while under his or her authorization. For this reason, letters of authorization should not be taken lightly especially if they are financial in nature. With authorization, the specific actions are carried out for a specified time.

With power of attorney, the agent can continue to act for the first person in any capacity until the first person revokes the power of attorney. This is done through a written and signed revocation that is sent to the person with the power of attorney and anyone else who knows the agent had power of attorney. In either case, if the first person dies, the power and authorization becomes void. For medical records, it should include file number, insurance number and claim information.

If it is legal information, the case number should be included and for financial matters the bank account needs to be included. In most cases the authorized person is a friend or family member and is not paid for his or her help. Letters of authorization are rarely notarized.

If it has excess information, there may be more than one way to interpret it, which could cause confusion. It should be typed in formal business style. A letter of authorization is a document authorizing the recipient to carry out a certain action. For example a bank account holder may write a letter to the bank authorizing a transaction, or authorizing somebody else to act on their behalf if sick. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now!

A bank authorization letter is written by the owner of a bank account to authorize a trusted person to conduct certain transactions in their absence. So you can find here this letter templates in PDF format. Here is a sample authorization letter to bank manager for your account statement.

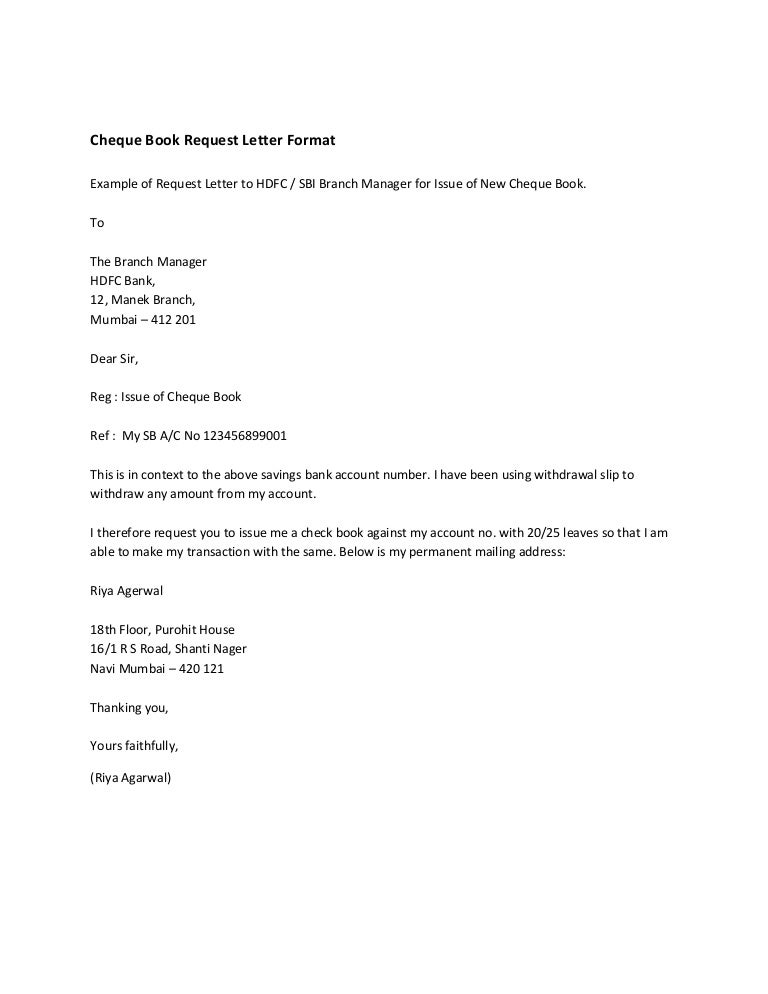

By using this ready to use and easy to modify Authorization Letter format for collecting a cheque book from the bank or postal office, you can be sure to have a professional letter template that you can personalize into your own authorization letter in order to let someone else collect a cheque book for you on your behalf. A bank authorization form is a document which is specifically used by banks to ensure that a claimant, as well as a depositor, is an authorized person who is legally permitted by the account holder to conduct a transaction associated with his bank account. It is addressed to the administration of the bank’s branch, in which the account holder had opened an account previously.

Simply state a letter of authorization is a legal contract made between two or more parties describing their legal authority, roles, duties, etc. Although this authority can be granted to anyone, it should preferably be granted to a responsible and a trustable person.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.