Can debt be forgiven due to financial hardship? How to write a hardship letter? What is a mortgage hardship? Explain in detail who will suffer.

Examples of financial hardship These authors also made note of financial hardship, specifically debt , that families may face , and its relationship to deprivation. Sample Foreclosure Hardship Letter. From Cambridge English Corpus He had staged the row, when his other income made the loss of the special lectureship no financial hardship at all.

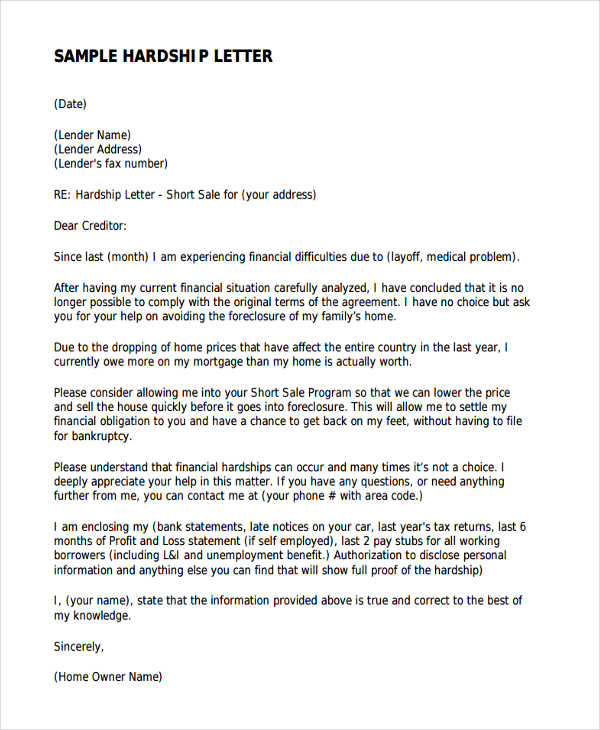

The Content of Financial Hardship Letters. Focus and write on the following: Your request. Specify the help that you need.

For instance, a decrease in your monthly payments for a loan for a stretched out payment perio or a recalculation of interest rates. Like Financial Contract Forms, a Financial Hardship Form is a legal document that formally records an individual’s claim of financial hardship. This form is a way of a person’s claim of financial hardship to be validated and be seen as a legitimate claim.

What’s worse is that you may be forced to take unpaid leavesonce you have already consumed your sick leaves, putting you in an even worse situation. In this case, your bank may consider your situation as an extreme hardship and help you with your payment settlement. We have tips on writing hardship letters as well as example letters, including hardship letter templates for mortagage, medical bills, immigration, and other personal and professional situations. My family and I are hard workers, but this expense would be an undue hardship upon our situation. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now!

The hardship is an explanation of events that occurred and why the individual can no longer make payment. In most cases, the receiver of the letter will understand the individual’s economic situation and agree to accommodate their needs in the short-term. Here are some examples of these types of forms: Medical Financial Hardship Forms are the kind of forms that are utilized by those people who are undergoing any form of. Patient Financial Hardship Forms are for those patients who are admitted into any hospital and who don’t have the money.

Under chapter of the bankruptcy code, you are only eligible to receive a financial hardship in-service withdrawal if you have unpaid medical expenses, a casualty loss, or unpaid legal fees incurred for a separation or divorce. For example, don’t mention that your rich father-in-law will give you the money if the letter you’re writing is ineffective. Your institution will likely deny your request and expect you to borrow it from your rich father-in-law instead. We’ll include a sample coronavirus hardship letter below.

Hardship and dependency conditions are based on the financial , emotional, and physical needs of a your immediate family. However, families of servicemembers often experience some financial hardship or psychological strain because of the disruptions of family life associated with normal military duty. For example, if the medical condition has made it impossible to work for some time, which has caused the income to be greatly reduce the details should be clearly stated. The letter should clearly state a settlement offer. Opening Paragraph Letter.

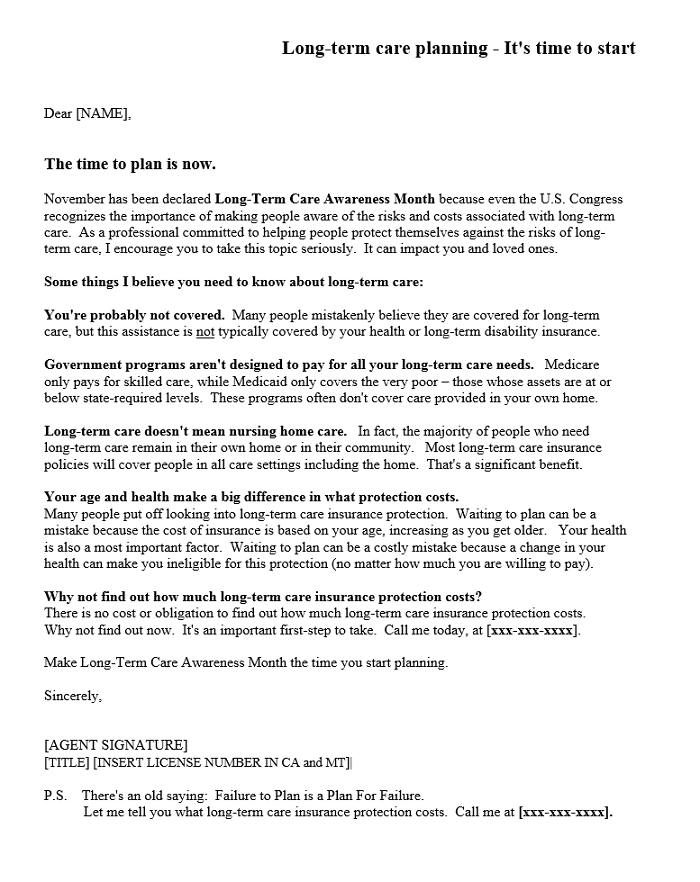

Start off your letter by clearly explaining why you believe your financial aid is getting suspende as stated to you according to the letter your financial aid counselor sent you. Having the option of taking an in-service withdrawal from your TSP account can be a lifesaver when you’re facing a financial hardship. But before you do, evaluate your options carefully and know the consequences. It’s a permanent withdrawal from your TSP account.

You can’t put the money back. This letter can be used in a variety of settings, for instance, requesting a loan modification, a short sale, or preventing foreclosure. Even if you have a lawyer presenting your case, a hardship letter strengthens your case to your lender.

Financial Hardship means a severe financial hardship to a Participant resulting from an illness or accident of the Participant, the Participant’s spouse, the Participant’s beneficiary, or the Participant’s dependent (as defined in Code section 15 without regard to Code section 152(b)(1), (b)(2) and (d)(1)(B)), the loss of the Participant’s property due to casualty (including the need to rebuild a home following damage to a home not otherwise covered by insurance), or other similar. Martinez Loan Agents. I have just lost my job, and have no income coming in. Financial hardship is often mentioned in relation to student loans.

A college student who used loans to fund her education usually begins paying off the loans shortly after graduation. For some, this major expense arrives before they have a chance to earn a decent living. The IRS lists the following as situations that might qualify for a 401(k) hardship.

However your choice of which financial form to use is not nearly as important as the evidence that is sent along with the form - letters from creditors or others showing that utilities are being. Unlike a 401(k) loan, the funds to do not need to be repaid.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.