Is input service compulsory under GST? What is GST registration? Who is required to be registered under GST?

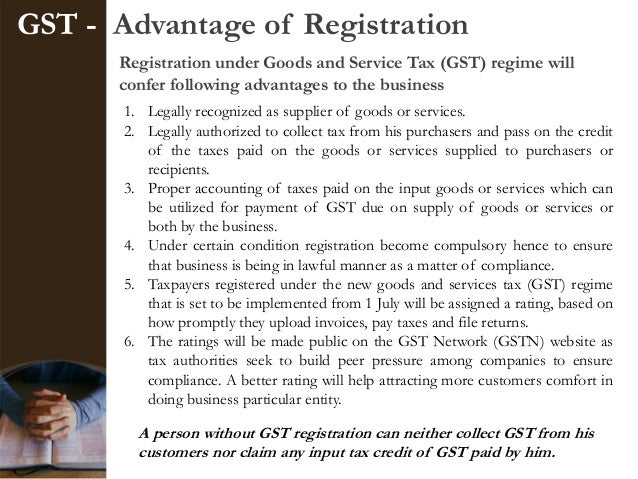

Thus, there are no centralized registration under GST, person having multiple place of business in a state or union territory may be granted a separate registration for each such place of business subject to such conditions as may be prescribed. Generally, the GST registration is compulsory only if the Aggregate Turnoverof a business exceeds the threshold limit during the financial year. However, in certain cases, compulsory registration under GST is required even if the turnover is less than the prescribed threshold limit. A taxpayer can apply for GST Registration on the GST Portal. However, there are certain cases that require compulsory registration under the GST regime even the aggregate turnover in a financial year does not cross the threshold limit required for registration.

The business has to get registered in the state from where he makes taxable supplies. Cases which GST Registration is compulsory. Is GST registration compulsory ? Who are the categories to be registered with GST compulsorily? We are required to deduct tax under section of GST Law.

Is our company required to be registered with GST compulsorily? I am a non-resident Taxable person. Is Registration for GST in India is compulsory. Non Resident taxable persons.

Persons liable to pay tax under RCM. Types of GST Registration. A person making taxable supply of goods or services or both and if his turnover cross lakhs in a financial year, he has to compulsory register under GST within days.

The limit in special states is lakhs. A given PAN based legal entity would have one GSTIN per State, that means a business entity having its branches in multiple States will have to take separate State-wise registration for the. Composition Dealer registration under GST. Any person who does not opts to pay tax under Section (1) of the CGST Act, and whose aggregate turnover exceeds Rs.

In the case of following States, the aggregate turnover limit is Rs. Are you liable to register for GST ? If person is making supply under Principal and agent basis then he need to get himself registered and prov of sec. I am service distributor, do I need GST registration ? Give it a read and we would be pleased to have your feedback!

The provision of compulsory registration has been diluted in the wake of various relaxation granted in the GST councils meeting held recently. Accordingly, the person who was required to get compulsory registration here in below for S. Y shall be liable to be registered under the GST ACT. There are cases where you turnover is less than prescribed limit but you still need to register for GST : Inter-state supply of goods (In or outside India): In case of the supply of services you can utilize turnover limits for registration.

Compulsory registration for GST. This limit has been increased to Rs. However, this rule is not applicable for people or goods belonging to certain categories.

Do we need to register under GST or not and please suggest. Supplier conducting business in rest of India whose aggregate turnover exceeds Rs. However, if a person makes supplies in the course of interstate trade he has to be registered under GST. Lakhs (Lakhs in special category states) need to take registration under GST.

However, the following categories of persons, irrespective of turnover, are required to take compulsory registration under GST. Government of West Bengal Finance Department Audit Branch. Threshold limit for GST Registration to Service Providers. Any business whose turnover surpasses the threshold limit of Rs.

REGISTRATION UNDER GST.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.