What is beneficiary designation? A “ beneficiary designation” is the simplest way to name who should receive your financial account when you pass away. For example , in a beneficiary designation, you can instruct. The beneficiary is the person who will receive the insurance benefit in the event the insured passes away. Choosing one or more beneficiaries is as easy as writing a name on the life insurance application.

A beneficiary account is a Demat account in the name of an Individual (single or jointly). Such an account could also be in the name of a Corporate, a partnership firm, a society and a trust. Payable-on-Death (POD) accounts allow you as the holder to name a beneficiary to receive the assets in the account at your death. One type of POD is a personal bank account —including checking, savings, money market, and certificates of deposit—and you may name either an individual or individuals, or a revocable trust, as your beneficiary. Who should you name as account beneficiaries?

How to add a beneficiary to your bank account? Should you add beneficiaries to your accounts? After your death, the account beneficiary can immediately claim ownership of the account. Before you set up your account , let’s examine the bank account beneficiary rules more closely.

Who Can Be an Account Beneficiary ? You’re in charge when it comes to. The beneficiaries are entitled to receive the entire balance of the available funds from a payable on death account , or transfer a transfer on death account to their own name without waiting for the reading of a will or the release of the estate by a probate judge or administrator. Distributing Property in a Will vs. Through a Beneficiary Designation.

Understanding the importance of beneficiary designation on bank accounts is a critical part of estate planning. Real Estate, Family Law, Estate Planning, Business Forms and Power of Attorney Forms. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! She would receive all assets at his death.

However, if the husband and wife both die at the same time in an auto accident, there is no living primary beneficiary. It is similar to a bank account. While the practice has advantages and disadvantages, it is not mandatory. No law requires a checking account holder to name a beneficiary. But if you have multiple Vanguard IRAs of the same type—for example , traditional IRAs—the beneficiaries you designate on one of them will carry over to all of them.

Generally, this may be a good option when people get along and there are no concerns about money going to wrong person. Option 2: Naming a trust as a TOD beneficiary. The bank and the beneficiary you name will do the rest, bypassing probate court entirely. Failing to name a contingent beneficiary —If the primary beneficiary predeceases the account owner, who then fails to name a new primary beneficiary , the ultimate beneficiary is determined by the terms of the IRA custodial agreement or plan document. One of them dies and the survivor fails to change the beneficiary designation on the survivor’s IRA.

For a retirement account such as an IRA, you may also name a trust as a beneficiary , and the asset will be distributed as described in the trust’s plans. As long as they are alive–a deceased person cannot receive property–you can name them as a beneficiary. You can name your spouse, children, other friends or loved ones.

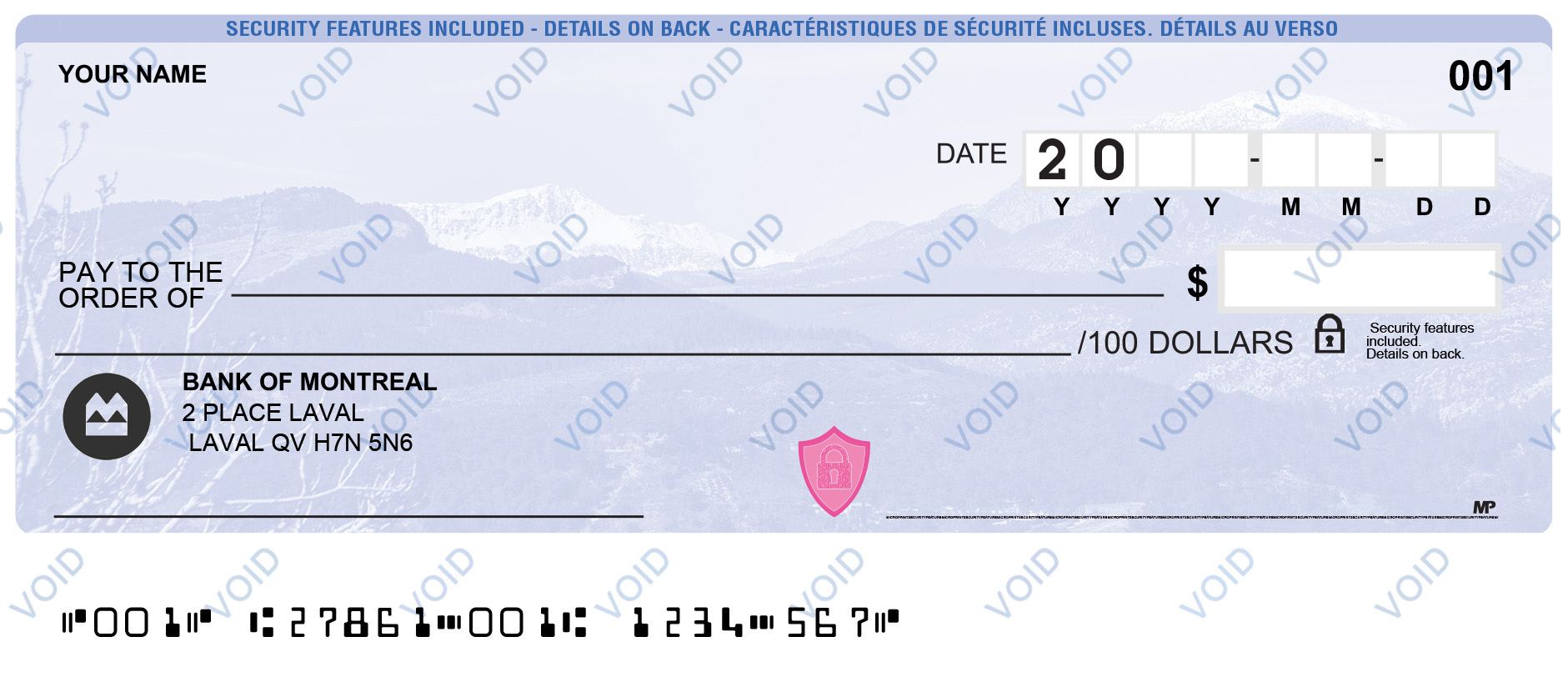

If you’re the spouse beneficiary of a deceased participant’s TSP account and your share of the balance is $2or more, we will establish a beneficiary participant account (BPA) in your name. You cannot make contributions to, borrow from, or transfer money into your beneficiary participant account. Account Owner’s Account Number Account Owner’s Social Security Number.

So, it often makes sense to name a spouse as the beneficiary for that kind of account. If you do wish to designate more than one beneficiary , another option is the split the IRA into multiple accounts and name one beneficiary per account. If the account has $130in it, the minimum withdrawal the first year would be $000. If you name your estate as beneficiary , the account will.

The reason could be people may not realize they can name a beneficiary , or they just never get around to filling out. Because these direct beneficiary designations.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.