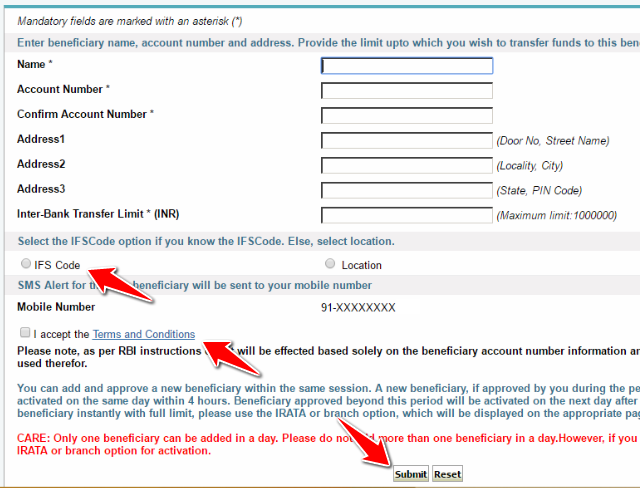

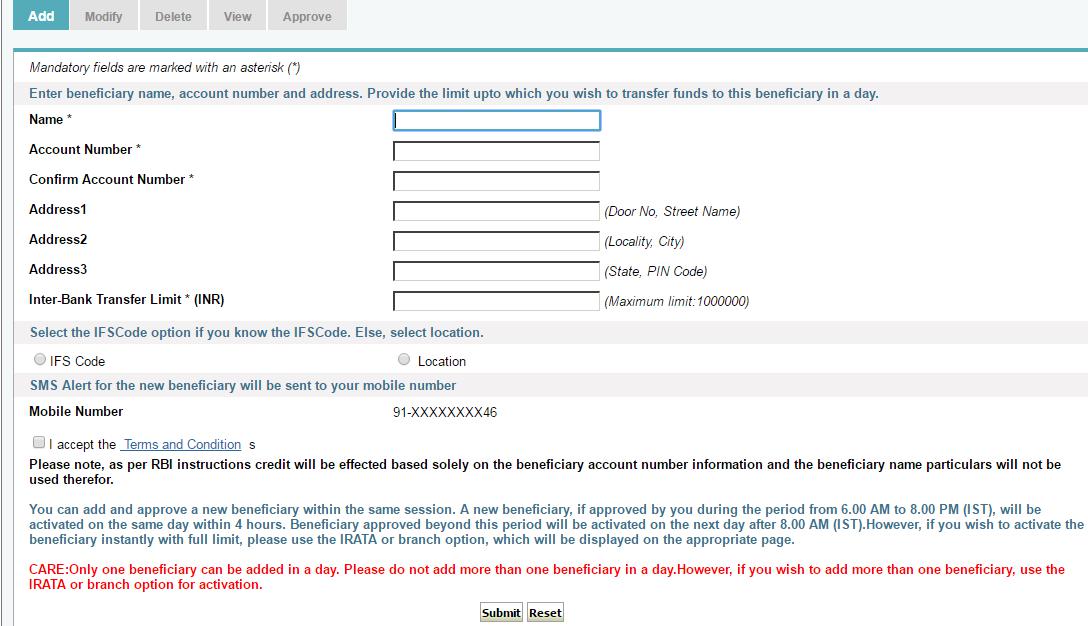

Now enter the beneficiary account name, account number and transfer limit and click on Submit. Note: Make sure to enter the correct Beneficiary Account Number since it will ONLY be used for Electronic Fund Transfer. Click on the ‘Manage Beneficiary ’ link in the ‘Profile’ tab. Select ‘State Bank Group Beneficiary ’. As an IMPS Beneficiary.

In the IMPS Beneficiary option, you can send money from your SBI Account to Beneficiary account within seconds. If you choose the IMPS beneficiary option, your transferred amount will be credited to the beneficiary account within the few seconds. How do I add a beneficiary to my SBI account?

How to add an inter bank beneficiary? Can I transfer fund from SBI to another bank in India? What is Imps beneficiary in SBI? Following steps are to be followed for adding an Intra-bank beneficiary -: Open SBI - Open your online SBI net banking account by entering the Username and Password.

Entre into the Profile section- Click on “My account Profile” section in header menu. Now, in the drop down menu click on “Profile”. SBI launched RTGS and NEFT systems to enable people to transfer funds of any amount from one bank to another.

Adding beneficiary account in internet banking of SBI is not a hard job. I have published the article on how you can add beneficiary in SBI by referring this linked article you can add an intrabank and interbank beneficiary in your SBI internet banking account. A virtual account number is a system generated unique account number which is based on logic and masks the original account number. Now you can add and approve only one beneficiary in each of the following categories: Intra-bank, Inter-Bank, VISA, State Bank Group and IMPS in a calendar day, which will be activated by the internet banking system within hours, if approved by you during the period from 6. Hello there In Indian cotext, in any Bank when you add another account as beneficiary , which is already there, so long as the account number is different, system will not reject.

Beneficiary can be added instantly by an OTP received on your registered Mobile Number or by IRATA reference number which can entered in any SBI ATM. Approving the Beneficary in SBI Online Now that you have completed the process to add a beneficiary in Online SBI , you need to approve this beneficiary in order to make it active for. Tollfree Customer Care Number of SBI. How To Complain Online to The RBI. The SBI Pay also provides a tollfree customer care number to book a complaint about the failed transaction, Non-credited transaction or any other feedback.

This feature is Quick Transfer. There is no limit for fund transfer in this step. In this guide on Online Indians we will tell you the complete procedure which you need to follow to add credit card as beneficiary in SBI Net banking. State Bank of India Internet Banking) But before we proceed make sure you have an working and active internet banking account. If the beneficiary ’s bank is unable to credit the beneficiary ’s account for any reason, the former will return the money to the remitting bank within hour.

Once the amount is received by the remitting bank, it is credited to the remitters account by the branch concerned. Enter the account number and nick name. The system will then display the account name.

It will show the beneficiary name as per bank records. You can cancel the process right then, or add the payee. Both these methods to find bank account name from account number should be used. Open the of the SBI online.

Login with your net banking user id and password. After that home page will page, from the menu click on the profile option and click on manage beneficiary account. Then choose either intra bank beneficiary for SBI to SBI and for SBI to other banks click on interbank beneficiary account.

Agar aapko kisi other person ke SBI account me paisa transfer karna hai to sabse pahle aapko wo person ka bank account Intra-bank beneficiary me add karn hoga. If International Bank Account Number (IBAN) needs to be mentioned then, please mention beneficiary ’s digits account number only in IBAN field. Intra-Bank Beneficiary add karne ke liye Intra-Bank Beneficiary par click kare. The generated QR code can be shared (by the beneficiary ) with any SBI customer to send money by scanning the QR code using Yono Lite SBI app.

The biggest advantage of using this fund transfer method is that funds can be transferred instantly without even adding the beneficiary in the account.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.