The property is tax-exempt, but you made payments in lieu of property taxes. The Minnesota Department of Revenue has certified the. When is property tax payable? Each place you resided in that financial year, you have to show the certificate that you have paid the rent. This form must be filed by January 31.

Why is this form used in Minnesota? Just as you can get some deductions as a landlor tenants in Minnesota can get some deductions, too! Eligible renters may receive a refund based on property taxes paid on their principal place of residence in Minnesota and their income. You can print other Minnesota tax forms here.

If the renter moves prior to December 3 the owner or managing agent may give the certificate to the renter at the time of moving or mail the certificate to a forwarding address if one has been provided by the renter. All lines on the schedule must be filled in. If all lines on the schedule are not filled in, paid rent will be divided by the number of occupants.

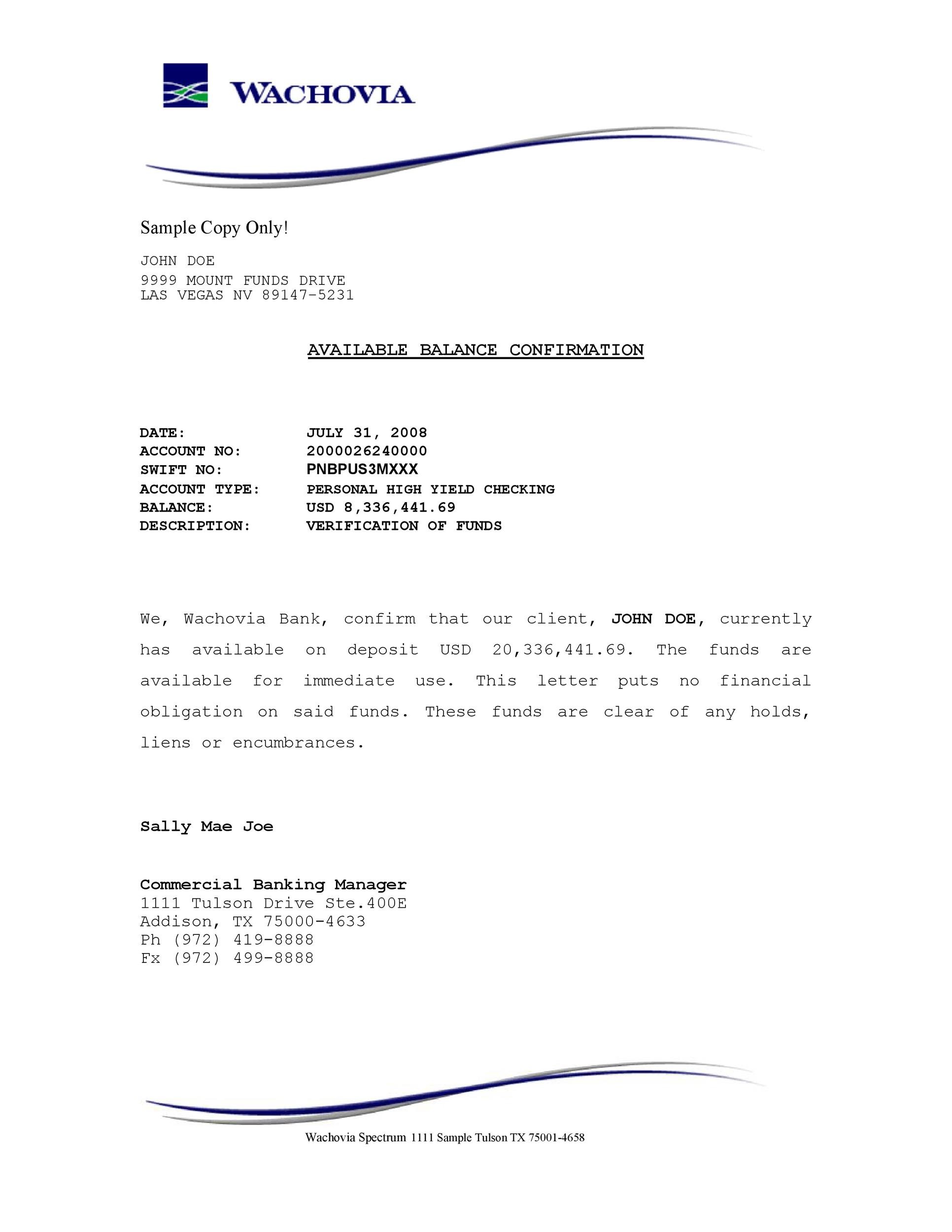

If you own, use your Property Tax Statement. Multiply Line by. Your Rental Occupancy Affidavit must be notarized. Certification of Rent Paid Form MO-CRP 1. New Jersey – The New Jersey benefit is interesting because it gives renters a choice as to whether they would prefer a deduction of percent of rent paid or a credit of $on their tax return.

To determine which option would put more money in your pocket, you have to do the math. Rent is the amount of money you pay for the use of property that is not your own. Deducting rent on taxes is not permitted by the IRS. However, if you use the property for your trade or business, you may be able to deduct a portion of the rent from your taxes. Complete this form if you lived in more than one location.

Use as many sheets as necessary. Submit a copy along with your Iowa Rent Reimbursement claim. Your last name, first name: Your Social Security Number: Rental Address. The location where you lived must be subject to property tax.

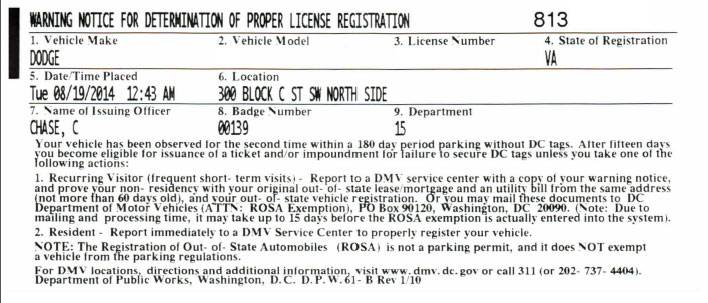

OWNER OR MANAGING AGENT TO FURNISH RENT CERTIFICATE. The owner or managing agent of any property for which rent is paid for occupancy as a homestead must furnish a certificate of rent paid to a person who is a renter on December 3 in the form prescribed by the commissioner. If the renter moves before December 3 the owner or managing agent may give the certificate to the renter at the time of moving, or mail the certificate to the forwarding address if an address has been. Use the Global Search, Leases List page, Lease Navigator, or page filters to locate the desired lease. Click the lease to open the Lease Summary page.

Click Generate CRPs under Related Activities on the left. The amount of rent paid by you, which exceeds of salary. A letter may also be required if a person applies to a state or federal assistance program.

Include any separate amounts the renter paid to you for items such as parking, a garage, utilities, appliances, or furnishings. Do not include rent amounts paid by a government agency as a subsidy, the security deposit amount, late charges, delinquent rent or rent for farmland use. Married filing separate Married filing separate taxpayers are limited to a rent deduction equal to of the rent each pays and cannot exceed $5per return. You must have your CRP to determine your property tax refund and you will include it when filing your property tax return. For many, this is a time-consuming task that consumes valuable time each and every year.

Some CRPs may have been completed with a mistaken amount on line B. My certificate of rent paid is not increasing my return at all. I am not claimed as a dependent, so I dont know why this is happening. Please tell me more, so we can help you best.

I have different certificates of rent paid. Renters will need this CRP to apply for a property tax refund. I’ve summarized the information to get you started.

I recently got my CRP from my landlord. TENANT’S AFFIDAVIT OF PAYMENT. Landlor that Tenant’s Work is described per the Lease, has been completed satisfactorily, that all contractors, laborers and material suppliers have been paid in full and that no liens have been placed against said property.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.