Shop Our Official Site To Compare Auto Insurance Rates Today! What is a standard insurance clause? How does a fixed indemnity plan work? Indemnity and Insurance. Subject to Section 12.

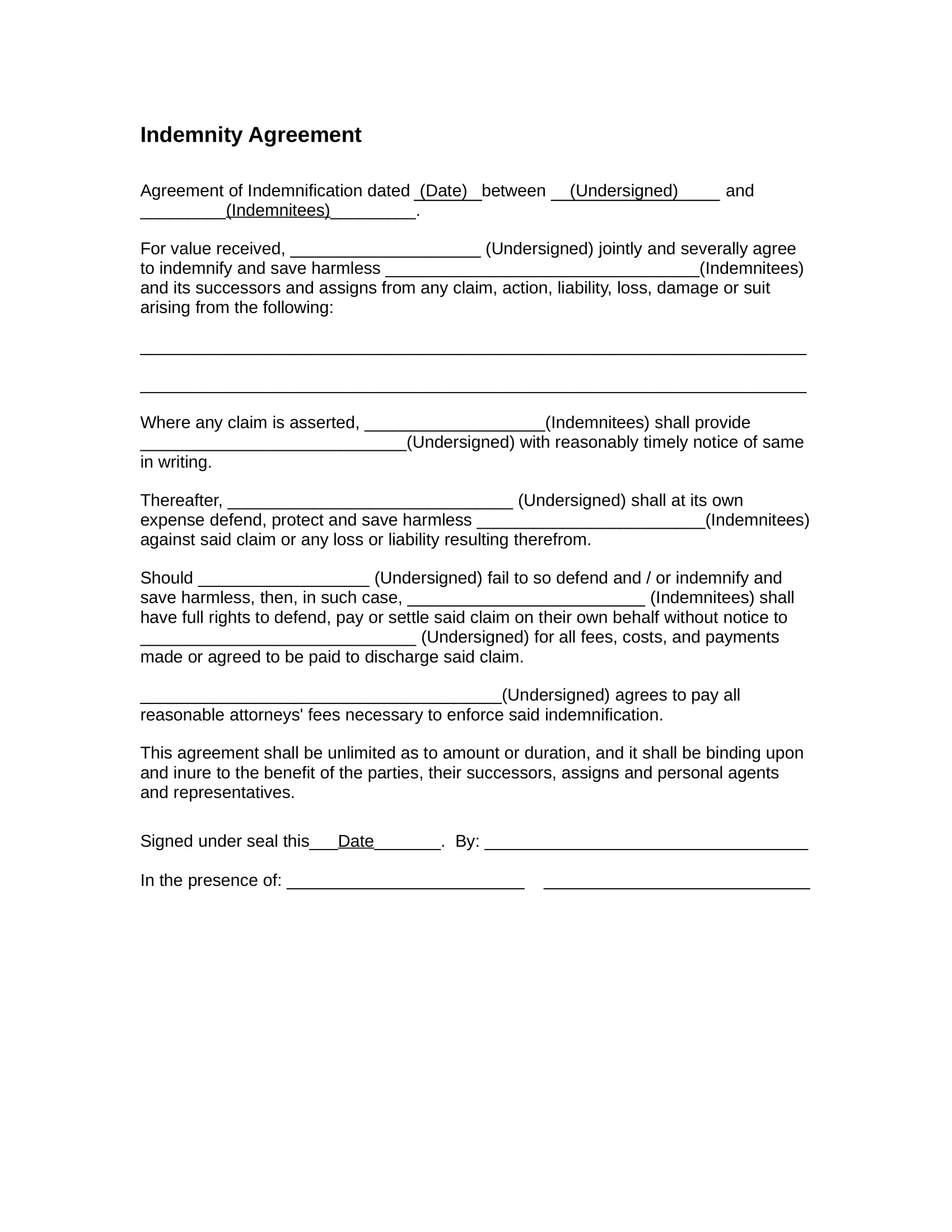

An indemnity clause, also known as an indemnification clause, is a standard waiver clause that states that one party won’t hold the other liable for damages , losses , or costs associated with incurred legal issues. For liability waivers, these potential costs are typically the loss, damages, or other legal costs that would arise from a lawsuit. In a legal sense, it may also refer to an exemption from liability for damages. The insurer promises to make the.

Kelley Many contracts contain clauses requiring parties to carry insurance and to agree to indemnify one party or another in the event of a lawsuit. Specifically, an indemnity clause states the conditions under which one party has to compensate the other contractual party for claims , unintentional harms , or other liability that could befall the indemnified party (i.e., the one to be compensated). This is usually due to the fault of the indemnifying party.

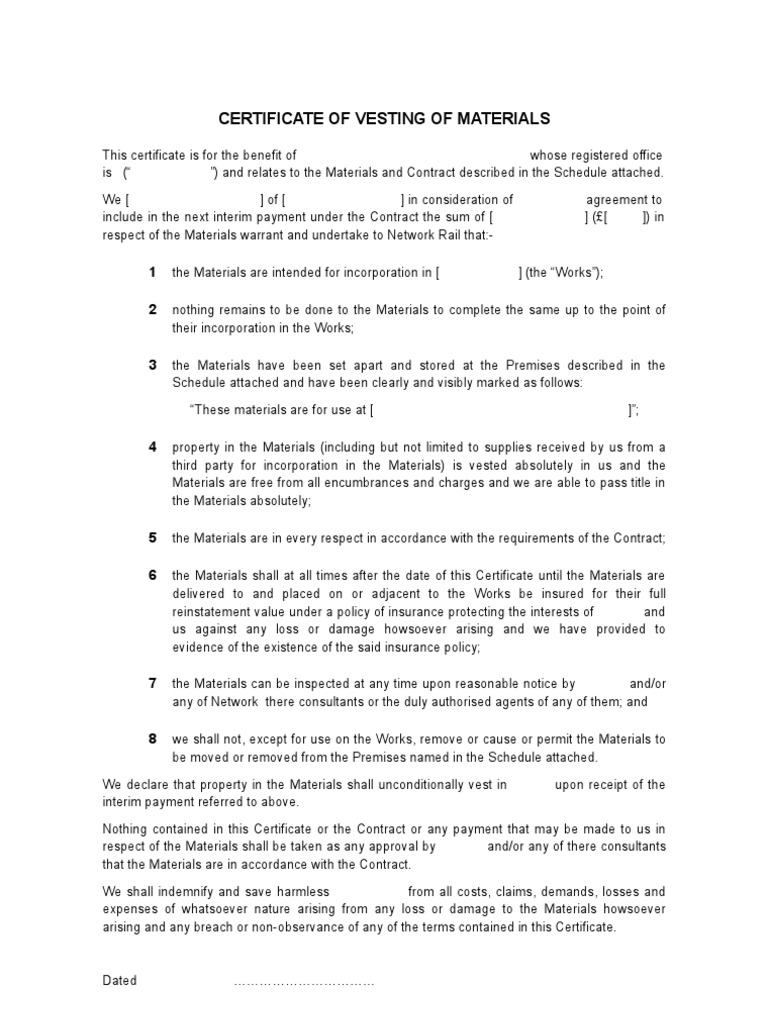

That is, the financial consequences of liability are being transferred from one party – the indemnitee – to another party – the indemnitor and that transfer is outside of an insurance policy. The terms of an indemnification clause can dictate how an insurance policy responds to hold an indemnitee harmless. It is important to note that a liability covered under an indemnity provision can exceed the indemnitor’s insurance limit. The Warrant Agent shall be liable hereunder only for its own gross negligence , willful misconduct or bad faith.

The Company agrees to indemnify the Warrant Agent and save it harmless against any and all liabilities, including judgments, costs and reasonable counsel fees, for anything done or omitted by the Warrant Agent in the execution of this Agreement, except as a result of the Warrant Agent’s gross negligence, willful misconduct or bad faith. Health Insurance Enrollment is Now. Find Your Best Policy Today. It is not necessary to establish fault or negligence by any person to apply this clause. If the parties have purchased insurance , they transfer the responsibility of indemnifying the aggrieved party to the insurance company.

Watch for a unilateral indemnification clause where only one party is being indemnified. With that sai indemnity and insurance agreements often go hand-in-hand. They are particularly useful when the actions of one party are likely to create a risk which the other party would otherwise have to bear. When it comes to car insurance, indemnity means that your insurer, like The Hartfor helps cover costs you’re required to pay following an accident.

Your auto insurance company indemnifies you from losses by shifting financial responsibility. Let’s say you’re at fault for a car accident that damaged your car and injured the other driver. Here is the indemnification clause being referenced: “Consultant agrees to add the city of Mos Eisley as an Additional Insured and to hold harmless and indemnify the city of Mos Eisley, its officers, agents and employees for all claims, legal expenses or judgements which is caused by any negligence, liable act or omission of the consultant or those acting in the consultant’s behalf in the performance of your ongoing operations with respect to this contract. Legally defined as, “to make reimbursement to one of a loss already incurred by him,” an indemnity clause states that one party agrees to “indemnify the other party,” or absorb the losses caused by the other party. Often, insurance policies (particularly public liability and professional indemnity policies) will specifically exclude cover for liability assumed under an indemnity clause that would not have arisen under general law.

All insurance is based on the principle of indemnity , which states that you are entitled to be. Liability insurance deals with non-property losses such as physical injuries, lost wages and. These contracts are usually not negotiate thus any ambiguities are construed in favor of the insured. By contrast, an indemnity clause contained in a non- insurance contract is construed against coverage, because the agreement creates duties that differ or extend beyond those established by general principles of law.

Whether the indemnification clause is found in an acquisition agreement, corporate bylaws or some other company document, policyholders should resist insurer assertions that coverage obligations are relieved by the presence of the indemnification language. Most insurers that make this argument ultimately back away from it. An indemnity contract arises when one individual takes on the obligation to pay for any loss or damage that has been or might be incurred by another individual. The right to indemnity and the duty to indemnify ordinarily stem from a contractual agreement, which generally protects against liability, loss, or damage. Even if you’re involved in an accident that you’re not at fault for, the indemnity clause helps protect you from financial loss.

For example, if another driver rear-ends your car, your insurer indemnifies you and helps cover your repair bill and medical treatment. An indemnification clause that requires party to indemnify each other for their own breaches of contract or acts of negligence will overlap with lawsuits for breaches of contract or acts of negligence. Parties need to ask themselves whether the indemnification clause as written expands or contracts their rights in such a lawsuit and whether this comports with their intentions. You want the indemnity clause, but also an insurance provision in the contract that requires that the contractor has insurance in place, as well as making sure that the managing agent or the board is listed as an additional insured on the contractor’s policy. That duty can only arise as a result of a contractual liability created through the indemnification clause of the contract.

Since this is a contractual liability, it is excluded from coverage pursuant to the contractual liability exclusion of the errors and omissions policy. An indemnification provision, also known as a hold harmless provision, is a clause used in contracts to shift potential costs from one party to the other. In a mutual indemnification, both parties agree to compensate the other party for losses arising out of the agreement to the extent those losses are caused by the indemnifying party’s breach of the contract.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.