It includes enacting the mandatory National Cabinet Code of Conduct and land tax concessions for commercial landlords. This includes a temporary hold on evictions and a mandatory code of conduct for commercial tenancies to support small and medium sized enterprises (SMEs) affected by coronavirus. Apply for land tax relief. Tenants should consider requesting rent relief , and landlords should prepare to respond as we will likely see a rise in tenant bankruptcies.

NSW Treasurer Dominic Perrottet is already one step ahea saying his government is waiving the rent of small businesses that rent space in government-owned buildings. We want as many of our businesses to remain businesses over a period of time and our workers to remain in jobs,” he told reporters in Sydney. Unless the tenant expects to have a higher income after Covid-than they did before Covid-, it. The land tax relief is. There’s also a longer six-month restriction if necessary.

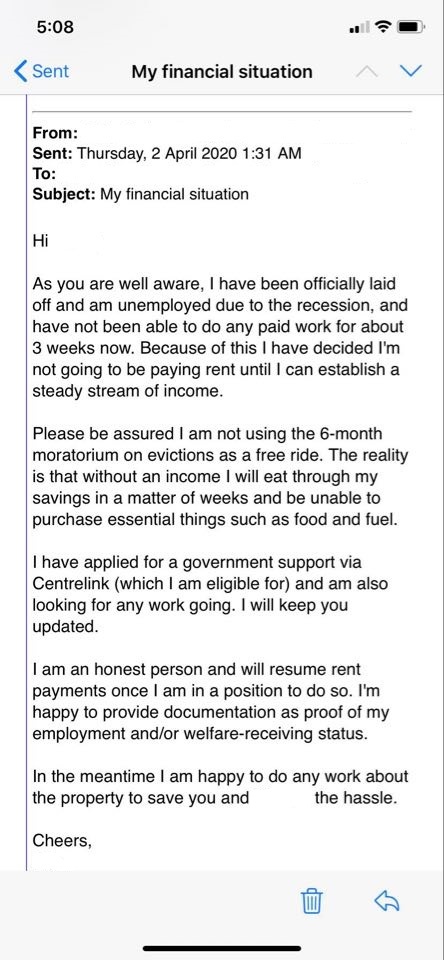

If a tenant qualifies, a landlord must “negotiate a rent reduction with the tenant in good faith in the first instance”. While the full effects of the virus remain to be seen, commercial real estate professionals need to be prepared for what could be a challenging time. Although there is no obligation for a landlord to provide any rent relief (in whatever form that may take), it is an avenue. While the Federal Government released the National Code of Conduct for Retail and Commercial Leasing and announced a moratorium on evictions, there was still some confusion on how the Code would apply in each state. Offers of rent reduction limited to the amount.

Service NSW cyber incident. Stamp duty changes for first home buyers. This program expands upon the previous rent relief program through MaineHousing. You can apply for this expanded program even if you applied and received funds under the other program. On April, the NSW government announced it had committed $4million to its renter relief package for both residential and commercial tenancies, though the plan has yet to pass in the state parliament.

COMMERCIAL tenants on the Coffs Coast are experiencing financial stress due to Covid-19. To help ease that stress, the State Government has announced a $440M land tax relief package. On the economic side, the struggles of restaurants and other.

COVID-(coronavirus) and gaming machine tax. Again, this theory is untested and would shift the burden to commercial landlords to process their own taking claims against the government. Landlords must “provide rent relief to the affected tenants of an amount at least commensurate with the land tax relief ” to be eligible. Rent Relief Package and Commercial Code of Conduct.

Networking for Business Outcomes : Tips and Techniques. Amazon gave free rent for March and April to all of its commercial tenants. Measures announced in relation to land tax relief.

New South Wales government is considering an extension to the commercial tenancy code due to expire in the state in. Do we have to stay open if we have a “keep open” obligation in our lease ? Tenants must be wary of this provision, if it is included in their lease , as it could lead to potential disputes with a Landlord. In almost all cases, commercial lessees who want to break the lease before the agreed end date must pay the rent until a replacement tenant is secure as well as any other associated outgoings, legal fees and advertising costs. While the government direction will take precedence over the lease covenant, the rent will remain payable.

When you enter into a lease on a retail premises, you are taking on a serious financial commitment. Let’s look at the different definitions in the statue of calamity. For instance, some landlords have provided temporary relief in parking costs, while others are offering rent abatements.

Some tenants are extending their leases in exchange for rent reduction. Landlords and tenants could work together to seek government assistance that would benefit both parties. However, as tenants’ business remains.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.