Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Can the executor of estate distribute funds? When do estate beneficiaries receive property? Is the executor required to show beneficiaries? If, after the distribution of desired personal property, beneficiaries have money yet to receive from the estate , it should be distributed at this time by the executor.

Follow the will to determine the distribution. Keep in mind that the distribution should be made to the beneficiary directly. See full list on how.

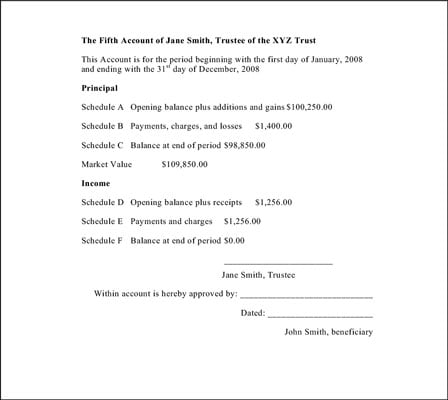

Each beneficiary (or nominee of a beneficiary) who receives a distribution from the estate for the tax year or to whom any item is allocated must receive a Schedule K-or substitute. Before you distribute the assets, you should review the will’s bequests and devises carefully. Be sure to follow the appropriate steps for distributing both tangible and intangible assets. Trust accounting uses a tier system to allocate taxable income among beneficiaries.

The federal estate tax now applies only to a tiny minority of super-wealthy taxpayers , estimated at about 0a year in total. Tier distributions are governed by section 6(a) (1). The beneficiaries of the estate are the people entitled to receive those assets. However, they may not be appropriate in all situations.

The executor is often, but not always, also a beneficiary. Part of creating an estate plan is to settle upon appropriate vehicles. A lawyer can help you identify if other options are appropriate. Any bills or dues that the estate must pay will be paid from the estate bank account. Any taxes that must be paid by the estate will come from the estate bank account.

Any distributions that the estate will make to beneficiaries will come from the estate bank account. If you are a beneficiary of a family Trust fun then there are a myriad of topics to understand how trust fund distribution to beneficiaries occurs. You see, the distribution of trust assets to beneficiaries happens when the Trustee, and if applicable, the Co-Trustee, meet all their fiduciary duty.

Once the Trustee (s) meet the fiduciary duty, they can complete the trust fund payout. Instruct your executor to divide assets equally. In essence, you are kicking the can down the road and leaving it to your executor to divide the property. A beneficiary in most cases is not being taxed on 1 of the income from the estate’s tax return.

Property and principal assets of the estate (which includes cash from the decedent’s bank accounts) are not taxed to the beneficiary since this is not included in IRD. THE BASIC PROCESS: The common reason for making a preliminary distribution of a portion of the decedent’s assets before the estate can be finally closed and distributed is to allow one or more beneficiaries to enjoy all or a portion of their inheritance before final distribution. Court policy favors such efforts.

The same goes for the successor trustee of a trust. These individuals must take several steps before an estate or trust can be closed or a trust, from valuing assets to paying any taxes due. Be sure that all debts, taxes, and expenses are paid or provided for before distributing any property to beneficiaries because you may be held personally liable if insufficient assets do not remain to meet estate expenses. Generally, when an estate or trust distributes property (other than in satisfaction of a pecuniary amount), no gain or loss is recognized on the distribution. If the IRA agreement spells out that distributions go to the estate when the estate is the beneficiary, then the only option for the executor is to take the lump sum distribution.

Otherwise, the executor will have to shop for a custodian that will allow inherited IRA’s for the benefit of the estate beneficiaries. Estate or Trust as Beneficiary If an IRA is payable to a trust that qualifies as a designated beneficiary under the Internal Revenue Code Section 4(a) (9) regulations, the IRA will, with some. What is an Interim Distribution of an Estate? Duties of administration. Within a deceased person’s Will, it is very likely that they will have appointed a person.

Right to interim distribution. Under Australian law, a beneficiary may receive their entitlements prior to the. Distribution of Trust Assets to Beneficiaries In the state of Arizona, trust administration is governed by ARS Title Chapter 7. Trusts are incredibly useful estate planning vehicles, but they come with a fair number of complicating factors.

Schedule K-allows your beneficiary to separate his or her income distribution into all the sorts of income received by the trust or estate. Therefore, if passive activity is distributed to a beneficiary of an estate and a IRC Sec.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.