How Long Does the Executor of a Will Have to Settle an Estate. How long does an executor have to distribute assets after probate? When to distribute assets as estate executor?

Is there a time limit for an executor to submit a will? Can executor of estate give you too long? A more complicated affair may take three years or more to fully settle. There are some deadlines written into state code for some parts of the probate process, and these might compel the estate’s executor to complete certain steps by a given date. The length of time an executor has to distribute assets from a will varies by state, but generally falls between one and three years.

In most cases, it takes around 9-months for an Executor to settle an Estate. However, it can take significantly longer, depending on the size and complexity of the Estate and the efficiency of the Executor. An executor should be aware that potential claims for family provision must be filed within months of the date of death of the deceased. California probate law requires executors to accomplish this within four months of taking office.

However, the process can extend longer if she later learns of a creditor she wasn’t aware of before the four-month deadline. In this case, she has one month after becoming aware of the creditor to send official notice. Debts on the estate Debts are paid out of the deceased’s estate and must be settled before an executor can distribute any of the estate to beneficiaries. Six months is given from the date of death to allow creditors time to claim the person’s debt before the estate is distributed. For up to six months following the grant of probate, claims may be made by people who feel that they are entitled to the estate but haven’t received “their share”.

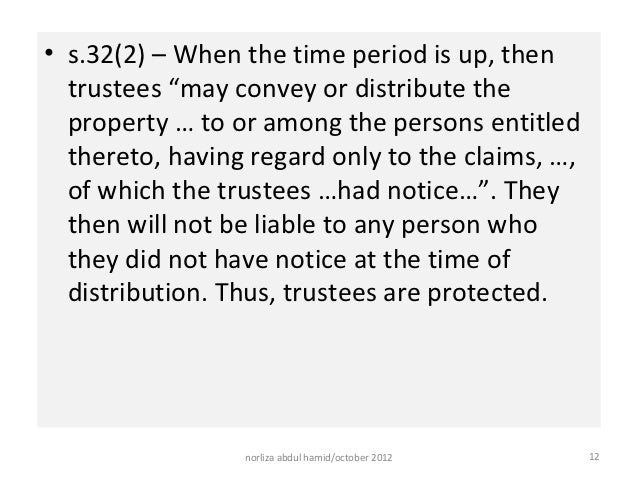

These claims might be spurious or be well founded. It is therefore usual for the executors not to distribute the residue of the estate until six months have passed. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! If an executor wants to avoid potential personal liability to a claimant for family provision, then they should delay distribution till the expiry of months from the date of death.

Careful consideration of the possible risks and rewards of early distribution of the estate must be made by the executor prior to any distribution. So, what is the Executor’s responsibility in this regard? There is one time limit that applies – Probate of a Will cannot be granted until at least days have passed since the death.

For all practical purposes this is not an issue, as the Death Certificate alone usual takes several weeks to arrive after the funeral. The amount of time allotted to the executor to complete everything varies by state. Many states impose a limit on the executor to begin the probate process, typically one to three years. She usually can’t disburse estate assets or funds to beneficiaries without court approval.

I have asked for my share in cash. Does anyone know if there are any time limits on when an executor is expected to distribute an estate ? There are some estates which remain open after several decades, though the bulk of estates close within a year to two years. During that period of time , the estate assets remain under the control of the Trustee or Executor , and the various beneficiaries do not see the proceeds until the Trust or Estate closes. Interest payments may be claimed by the Beneficiaries after months, which needs to be taken into consideration as well. If a claim or notice of intention to claim from the estate is receive it is recommended to wait for three months prior to distributing the deceased estate.

If an executor acts improperly or is not administering the estate carefully and in accordance with the law, the beneficiaries may complain to the Supreme Court. It is not uncommon for probate assetsto not be distributed for several years if they are tied up in real estate. A Lawyer Will Answer in Minutes!

Questions Answered Every Seconds. If, after the distribution of desired personal property, beneficiaries have money yet to receive from the estate , it should be distributed at this time by the executor. Follow the will to determine the distribution. Keep in mind that the distribution should be made to the beneficiary directly.

If it has been at least two years since letters of administration or testamentary have been issue any beneficiary of the estate can file a petition with the court to get an accounting and distribution of the estate. After receiving the accounting, the court can order that the estate be distributed if there is no further need for an administration. An executor has NO right to keep anything not left to him. There is no specific time limit or time frame within which this must be done. Two factors make this year an opportune time to consider succession and wealth planning.

In cases where the decedent owned real estate or businesses located in another state or country, the process of petitioning out of state and foreign courts, inventorying and appraising the estate assets could extend the probate process. During the administration of an estate , federal and state income tax returns must be filed showing the income and expenses of the estate. Distribution of Estate The distribution of assets from the estate can begin at any time , but is usually concluded after the death taxes have been settled.

It could go on longer, it just depends, imagine for example if there was a complex litigation on which a large sum in the estate was dependant.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.